Your operating plan is not a financial or fundraising document: It has to be a plan you actually believe you can execute. To run a successful startup, you absolutely need one.

Your operating plan is not a fundraising document

Your operating plan is not where you show the hockey-stick growth that investors would love to see in all of their investments. Yes, there is a scenario where you exceed every goal and beat every milestone, but that’s not a plan. That’s a dream. Most startups see a gradual progression, and if your operating plan relies on short-term exponential growth, you’re setting yourself up for failure.

I see many detailed operating plans in which the fatal flaws are immediately apparent. For example, if I read that a hardware start-up has a functioning prototype in August and is planning to ship in February, I know the plan is unrealistic.

Above all, what a poor operating plan shows me is that the founders haven’t taken the time to question themselves honestly. If the knowledge required to make accurate forecasts doesn’t exist within your team, you must seek it out through experienced investors, advisors, peers, and mentors, who may have more experience in the field.

Creating your operating plan

There is no mystery to writing an operating plan. An operating plan is a list of everything you intend to do as a business over the next 6–12 months. Think of it as a month-by-month to-do list for all aspects of your company.

An operating plan is a spreadsheet with a column for each month that should include the information most important to driving your startup forward:

- For which roles do you plan to hire, and when do you plan to make those hires?

- How are you going to spend your funds?

- What is your funding situation? (When will you run out of cash? When do you start raising your next round? How much are you raising, and by when do you need it?)

- When do you realistically plan on shipping your product?

- What are the intermediary milestones on the way to shipping?

- How many units are you expecting to sell? If relevant, how does this affect production, inventories at hand, and logistics? How do your unit economics assumptions affect your business?

- What are the key customer metrics that prove your business model? (NPS score? Sales? Monthly active users? Revenue? Annual recurring revenues?)

- What are the key company value-creation milestones you intend to achieve?

The list above is simple, common-sense operational planning that you, as a founder, should have clear in your mind. In this post, I’ll outline some steps you can take to write a comprehensive, dynamic operating plan.

Plan for what you can see

No start-up has the foresight to see much beyond the next 6–12 months. Plan for what’s visible to you.

I think of operating plans as modular, rather than linear. Each module is a smaller milestone — I like to call them “gates’”— that describes a dependency. Being aware of these dependencies helps you focus on what needs to be done.

An example might be to achieve a target in monthly recurring revenue (MRR) before making a new hire. Make it explicit: You won’t hire a new engineer until you have an MRR above $20,000 for three months in a row. Other good examples are hitting a specific milestone on shipping products, customer acquisition milestones, the number of hires you’ve made, or closing a funding round.

Over the period of your ops plan, you must pass through certain gates before advancing to the next one, eventually landing you at the milestones that mark the true progress within your business. A good operating plan will have a few of these gates, which can help you make decisions based on objectively measurable criteria.

Update the plan regularly — but not too often

Your operating plan is never “done”. Things move quickly; circumstances change; and the second you finish writing the plan, elements of it are probably out of date. Updating is important, but it is possible to update the document too often. Aiming to update the operating plan twice per year is sensible. Create a plan at the end of the calendar year, and update it towards the middle of the year.

It’s important to be honest about falling behind on your plan.

You want to be able to work to your operating plan. This is important both at board meetings and to help guide your team. You also want to show how you’re performing against the plan. If you are falling behind, it’s important to be honest about that, rather than presenting a new plan where you’re suddenly “back on track,” but on a new timeline.

If something triggers re-planning, analyze why the re-planning is necessary. A plan that is updated continuously isn’t a plan at all: It is a to-do list. What was wrong about the assumptions in the original plan, and how can you avoid that in the future? If you’re always too optimistic in your planning and never able to hit your milestones, that’s not helpful. Overly aggressive timelines are nothing to be proud of: That doesn’t show ambition; it shows that you’re not good at planning.

As an investor, a startup falling behind on the plan usually doesn’t worry me — it happens all the time. Companies should get into the habit of tracking dates in the plan, versus the date when something was actually achieved. A good operating plan isn’t something you religiously adhere to — it helps to keep you honest — with investors, your team, and more importantly, with yourself, as a founder and leader.

Making trade-offs in your operating plan

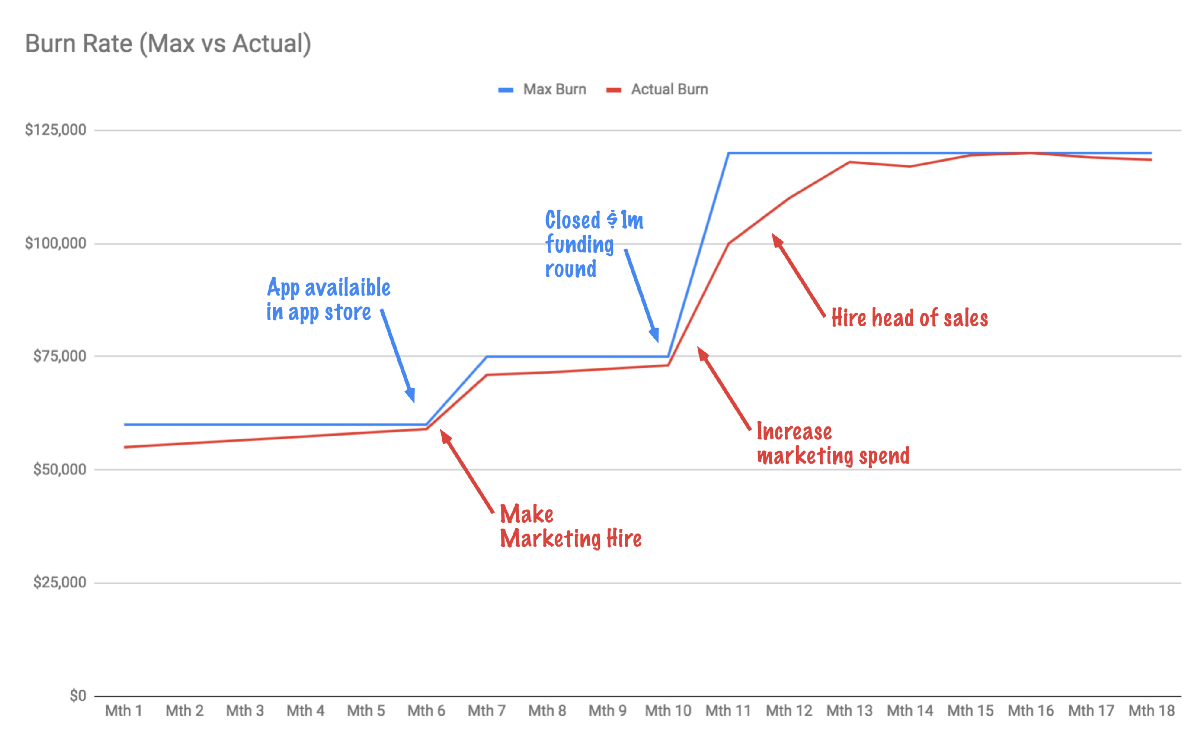

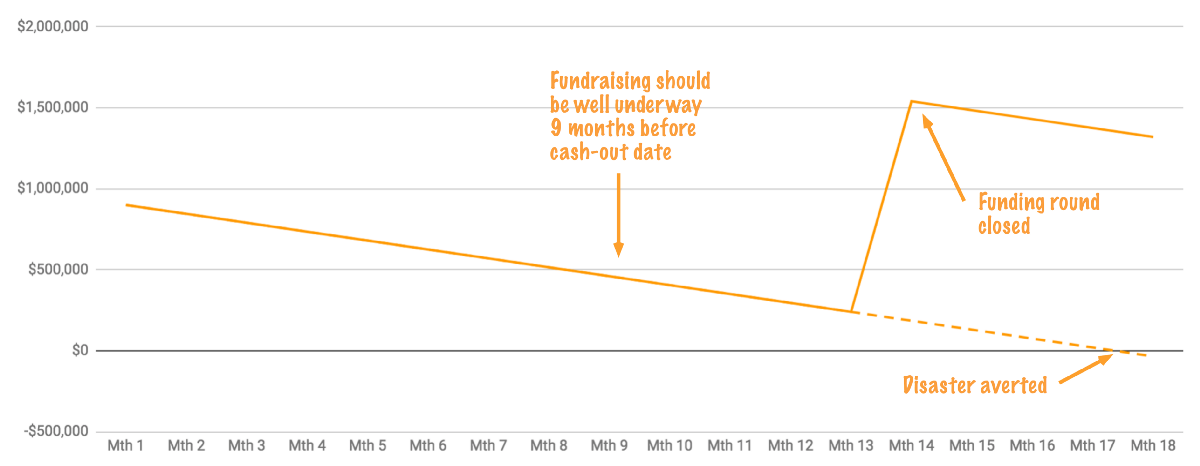

The most important number to pay attention to is the cash flowing in and out of your business. If you have $900k in the bank and are steadily burning $55k per month, you have perfect predictability as to when you run out of cash — 16 months from now. The easiest way to work this into an operating plan is to operate with a max burn rate. Within that figure, you can choose to how to prioritize your spend.

A great operating plan helps you identify earlier when your burn rate is higher than you hoped. This buys you enough time to to course-correct.

Being strategic about fundraising is crucial. Ideally, you raise more funding from a position of strength, when you can, hand on heart, say “we don’t need money right now.” That means, ideally, that your fundraising process is well underway when you have nine months of runway left. If you are running out of money in January, you need to have closed the fundraising round by September. For that to happen, you have to start fundraising mid-summer.

If you are selling more than you expected, you have more money coming in, and that’s where the plan has a little bit more leeway. Perhaps you can make a hire earlier, spend more on consultants, or plow more money into marketing, to further accelerate your plans. If you’re selling less than expected — or if product development is costing more than you anticipated — the opposite should happen. Hit the brakes, and spend less on marketing, delay expanding the team, or let people go, in order to reduce your burn rate.

A set of equations with no solution

Maintaining the discipline to sit down and write a month-by-month operating plan is your best shot at hitting or exceeding your targets. If you believe you’re going to sell 10,000 units by the end of the year, work backward from that date. Setting high targets for yourself can feel like a noble endeavor, but impossible goals can leave you with a set of equations and no achievable solutions.

The most common mistake I see is that a lot of founders aren’t realistic about what it takes to ramp up. In the hardware space, for example, you’ll probably need a contract manufacturer. This means you have to bake a number of lead times into your plan, planning for tooling and manufacturing. You have to be aware of Chinese New Year, lead times for parts and components, and the time it takes to ramp up to full manufacturing speed with acceptable yields. And on top of all that, not everything can be parallelized. Nine women can’t make a baby in one month; throwing more resources at the problem doesn’t necessarily make things go faster. Hiring is another example of where I see a lot of naiveté in operating plans. A three-person company can’t hire five people in six weeks.

Creating a fundraising deck will be much easier if you are in the habit of working to a solid operating plan. In my experience, when founders struggle to formulate a compelling pitch, it is often because they haven’t had the discipline to think through the business operationally.

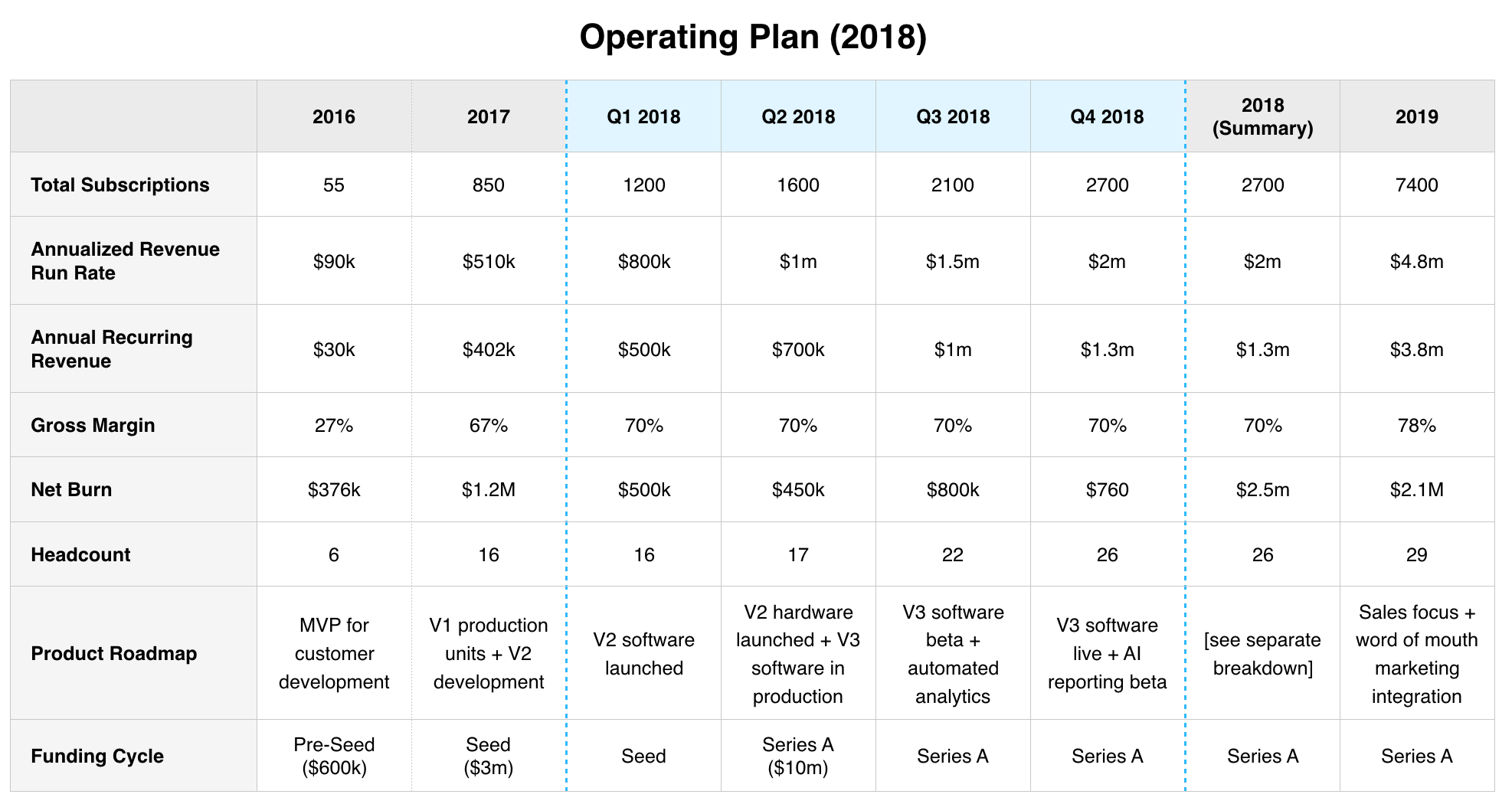

A sample operating plan

Every business is different, which means that there is no one-size-fits-all operating plan template. Having said that, below is a simple, high-level summary of an operating plan. Yours should be more detailed, and on a month-by-month basis, rather than quarterly.

Each cell in your operating plan should be a SMART goal, which means you can measure the company against the operating plan. The CEO will have an underlying monthly plan, with an in-depth analysis for each number, and specific plans for whom will be hired when, of course.

Bolt invests at the intersection of the digital and physical world.