Over the past few weeks, our team at Bolt has quickly shifted gears to work with the founders we’ve backed to adapt their operating plans to the rapidly evolving global environment, brought on by the coronavirus pandemic.

Having co-founded a venture-backed company during the ‘87 crash and guided venture portfolios through the dot-com bubble of ‘00 and the ‘08 financial crisis, I’ve learned a number of lessons about how founders early in their journey can improve their chances of navigating economic downturns.

There are select companies who will benefit from a pandemic-related downturn. Most will not. These guiding principles will help you have a shot at surviving the recession and coming out the other side stronger.

The strategy for adapting at the pre-seed and seed stage is distinct from later-stage startups with material revenue coming in and large headcount. If you’re running your business efficiently while proving product<>market fit, your relatively low burn and high agility is your superpower. Take advantage of it.

Each dollar of capital in your account is now more valuable than it was three weeks ago and should be reevaluated accordingly. While many VCs have been vocal about continuing to make new investments in this climate, we anticipate that will change dramatically over the next several months as we slide deeper into a global recession. If history is an indication, we can expect VC checkbooks to be largely closed for the next year or more until the macro-economy begins to recover in earnest. This will impact all facets of the fundraising equation across every industry – fewer checks, lower valuations, smaller rounds, and increased traction expectations.

As a pre-seed founder, your #1 objective right now is to be in a position of strength by the time the economy recovers. Regardless of product category, survival depends on the following:

- Hit the brakes on cash burn harder and faster than you think you can.

- Bring cash onto the balance sheet. This may be in the form of investment, revenue, or creative non-dilutive funding.

- Build an operating plan that allows you to operate for two years, even if that means hitting the pause button.

Hit the brakes hard and fast

Your ability to adapt quickly while your company is young and baseline burn is low is your competitive advantage. If you need to extend your runway, hit the brakes on cash burn hard and do it now. The earlier you cut burn, the less severe the cuts will need to be.

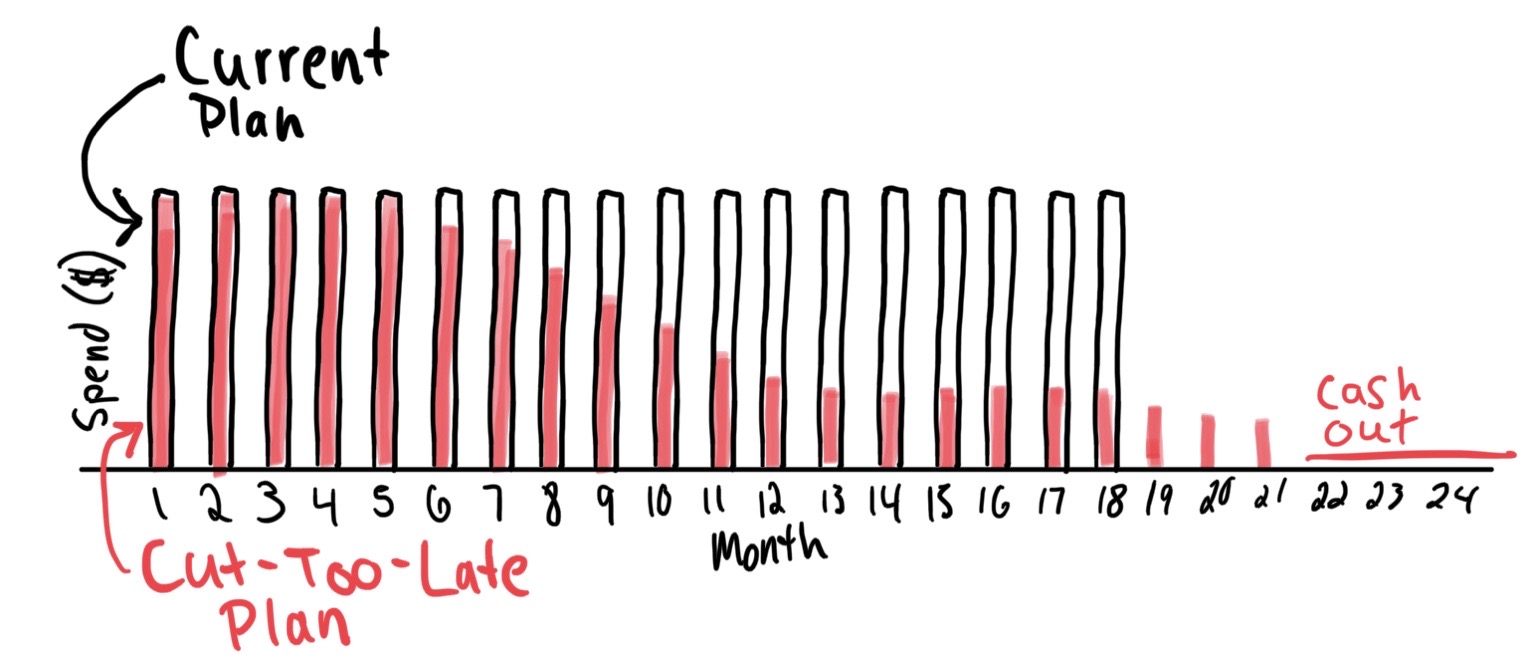

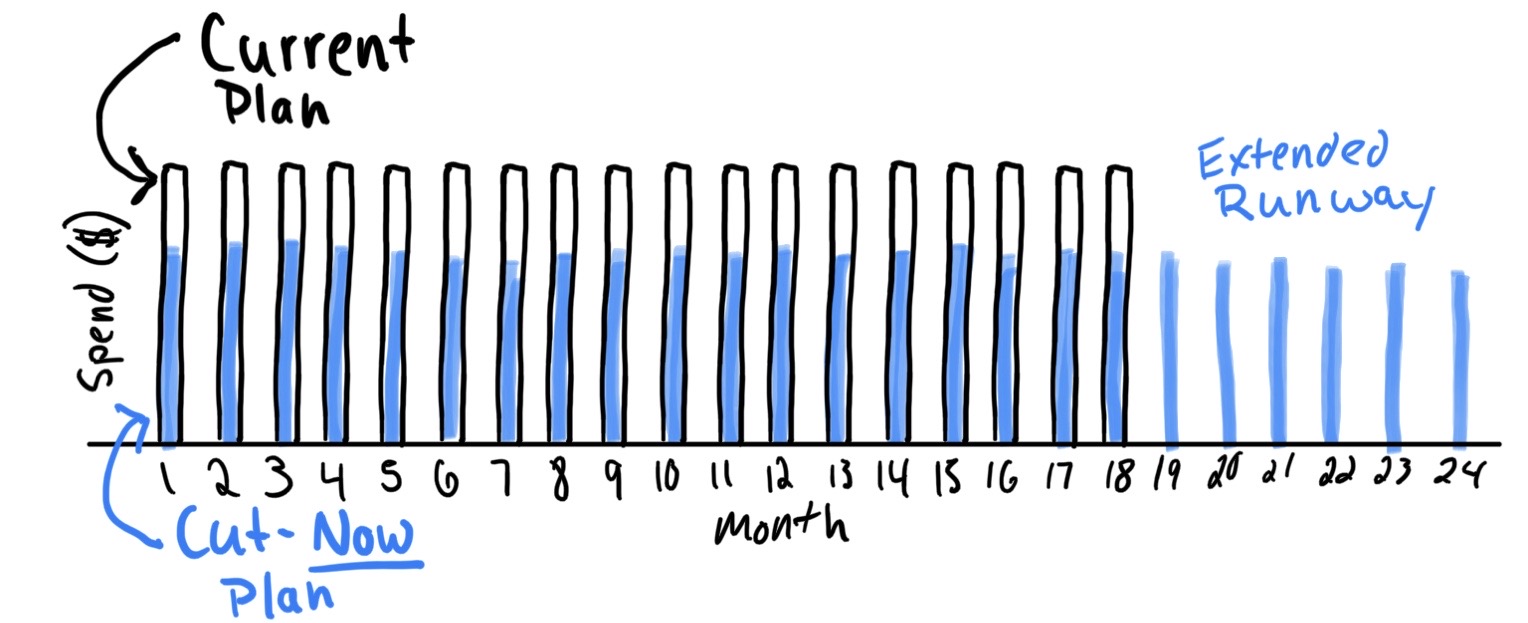

As a simplified example, say you’re adjusting your 18-month cash-out plan to a 24-month plan (see point 3) with no new cash from revenue or financings. Each additional month of burn at the status quo will increase the severity of burn reduction in the out-months and may even prevent you from making it to 24 months (the “cut-too-late plan”). By cutting burn by a meaningful amount now, you can put those savings to work in later months and prepare to raise your next round from a much stronger cash position (the “cut-now plan”).

It may be tempting to postpone major cuts out of fear that it will make you a less attractive target for a Hail Mary acquisition as the funding environment deteriorates. The reality is that M&A will also grind to a halt, making the chances of a graceful landing slim to none.

Cash is king

Most pre-seed companies do not have two years of cash in the bank, even with extreme cuts. It’s time to get creative. If you have an open financing on the table, your ability to structure an ideal round will diminish by the hour. Take the money while it’s still available. If existing investors are supportive of putting more money in to support runway extension, take it.

Take an extremely hard look at what’s immediately available: what can you do to bring any revenue in the door? Focus on selling off existing inventory, milking paid pilots, anything that will give you a chance to further extend your existing cash.

Taking on venture debt will seem like a solution to extend your runway or avoid making cuts, but it typically makes the situation worse for an early stage company. We’ve found it is extremely painful to bear given the poor visibility into when venture funding will recover and often greatly complicates future financings.

Have a back-pocket plan and be ready to use it

Even if you’re in an industry with minimal impact from the downturn or have target customers who have recovered quickly, it will likely take a year or longer for venture financings to return to a healthy state. This may lead you to incredible customer traction and market validation over the next 12 months, but what will it matter if VC checkbooks are still closed when you’re running out of cash?

Extending your runway and operating in a hyper-lean way gives you the best chance to raise when the venture ecosystem recovers. Reworking your operating plan to aim for cash flow break-even on your current funds is the absolute best thing you can do. This isn’t possible for all businesses, but interrogate your operating plan and see if it’s possible for you. Short of a feasible break-even plan, the next best situation is to plan for 24 months of runway or more on your existing cash with rock-bottom burn.

This is not the time for “move fast and break things,” this is the time for “go slow to go fast.”

For some companies, “slow,” may even mean putting your company into hibernation mode while your customers and investors recover. It’s ok to hit pause and take a few months to let your side-hustle pay the bills. This may mean delaying a launch by a year or more. There is no shame in this.

While the rate of change over the past few weeks has been disconcerting for us all, I feel fortunate to have seen the startup community weather similar challenges more than once before (albeit, with some difficult lessons along the way). We will all endure, and those quickest to adapt will thrive.

Bolt invests at the intersection of the digital and physical world.