Note: This post was from 2015. Click here for an updated breakdown of investment trends. Click here for an updated list of the most active hardware investors.

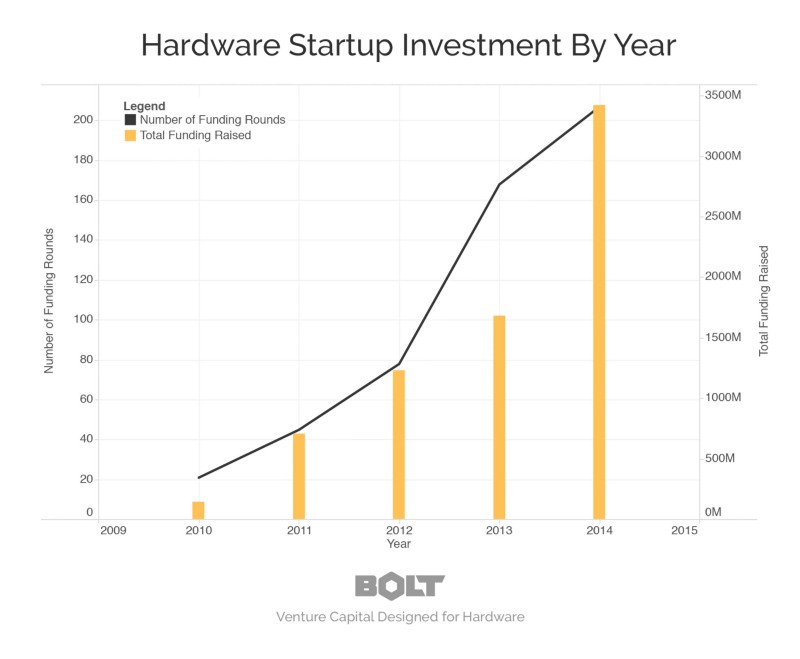

While many angels and VCs are still skittish about hardware startups, there has been a massive renaissance in the hardware funding ecosystem over the last few years. Since 2010, venture capital investment in hardware startups is up more than 30x:

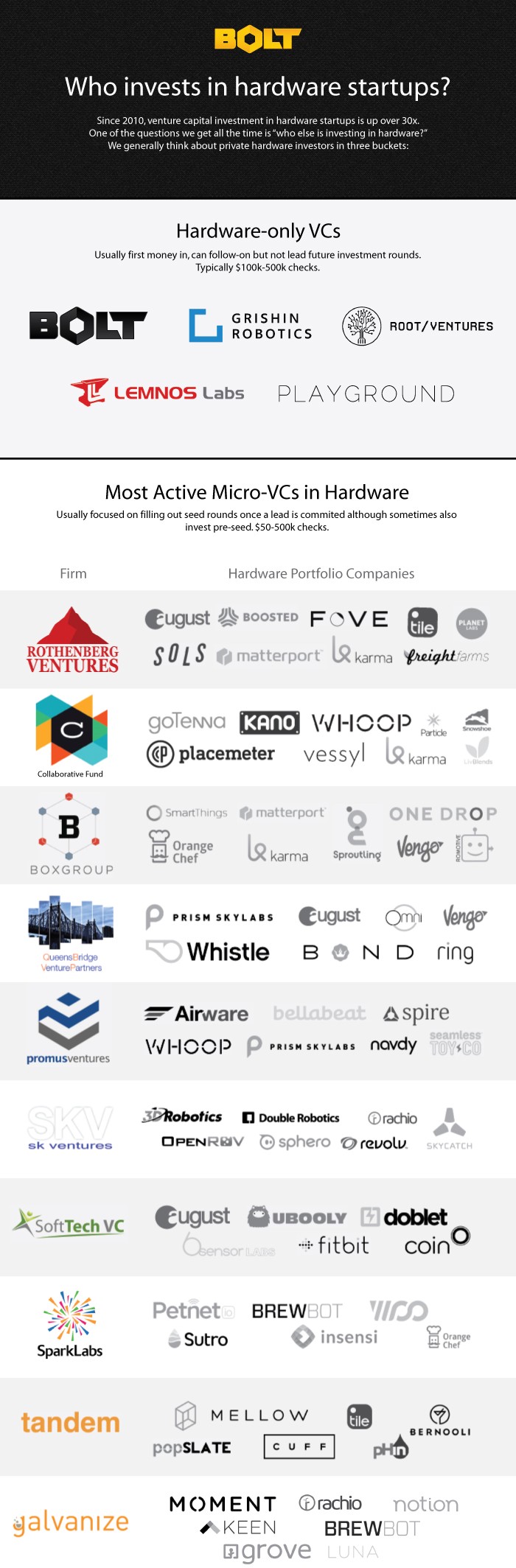

With this explosion in hardware funding, one of the questions we get all the time is, “who else is investing in hardware?” We generally think about private hardware investors in three buckets:

- Hardware-only VCs

There are a few small funds (like ourselves) that only work with hardware companies. We’re usually first money in and can follow-on but not lead future investment rounds. - Hardware-friendly micro VCs

There are also a number of other micro VCs who invest at the seed stage but aren’t focused on hardware exclusively. They generally manage less than $100M, invest $50k–500k and fill out seed rounds, but often don’t lead. - Hardware-friendly traditional VCs

Generally, most capital in hardware investment is made up of traditional VCs, with a few being particularly active. This is especially true for consumer hardware companies.

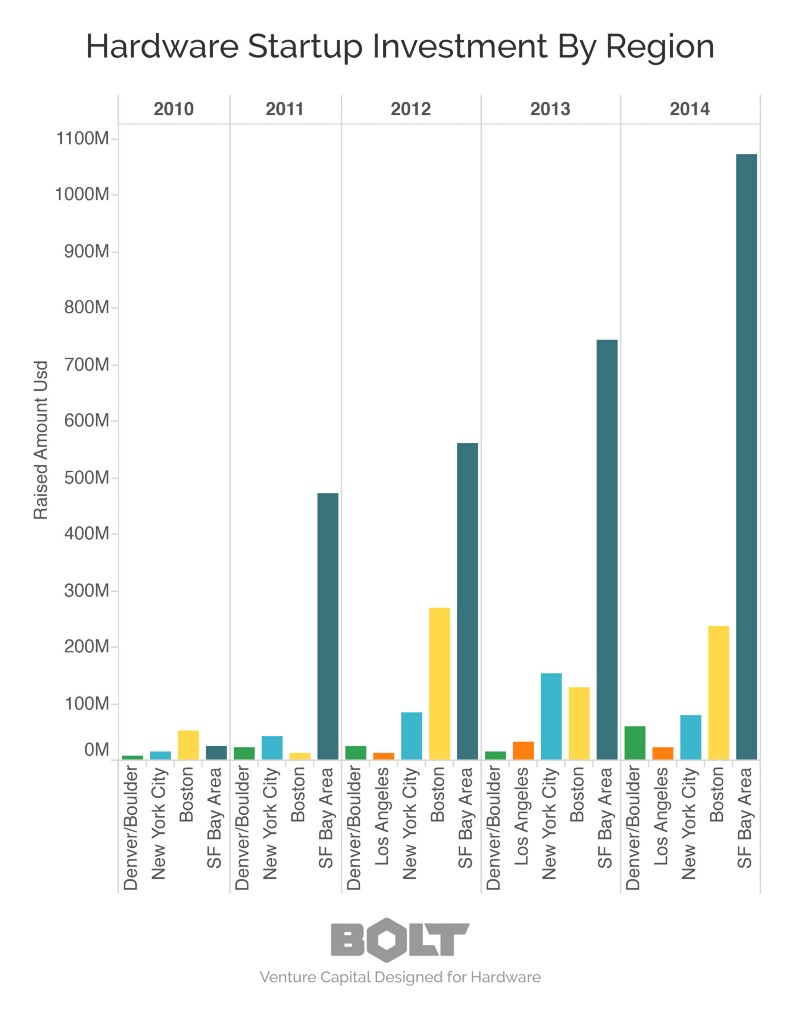

Where is all this activity?

The number of funded connected hardware startups in the Bay Area (who have publicly raised $1M or more) currently sits around 110 by my count. Boston and NYC (which are about equal) are one-third of that. Los Angeles and Boulder/Denver are one-third again of Boston and NYC. By aggregate dollars raised, however, SF completely dominates. It was almost 5x Boston in 2014 and over 10x NYC and Boulder. Everywhere else (including internationally) is a rounding error with a few very notable exceptions (Xiaomi, DJI, and Magic Leap, in particular).

Why now?

Three main dynamics have been driving private investors to seek hardware companies:

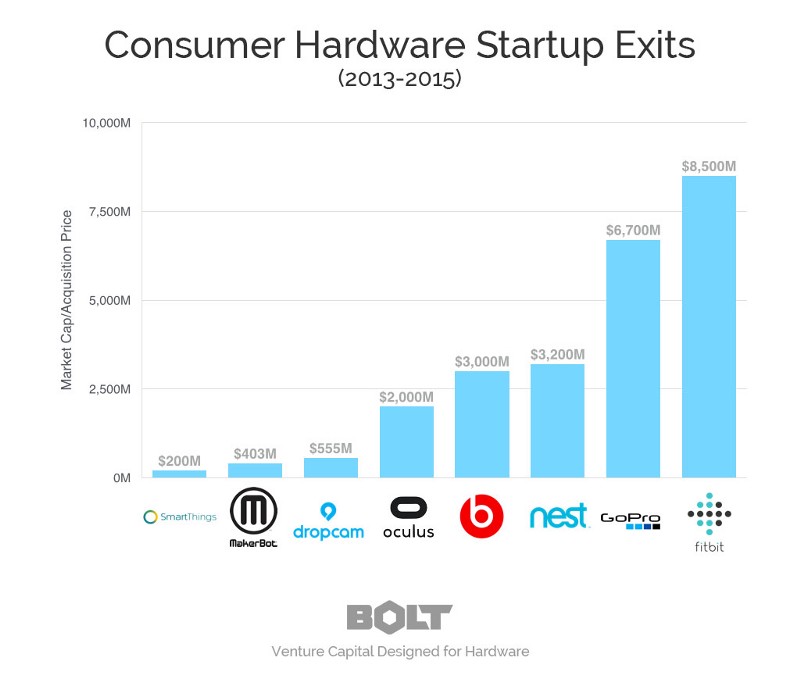

Strong Exits

A few breakout companies have paved the way in proving that hardware companies can be tremendously profitable. Distribution and manufacturing are still hard, but GoPro and Fitbit have shown that hardware can have stronger growth metrics and outcomes than their software-only counterparts.

SAAS-like metrics

While traditional hardware companies have few feedback loops besides revenue and returns, connected hardware startups get constant feedback on product usage, retention, and churn. This speeds up iteration cycles and helps investors (who are already comfortable with SAAS) understand younger hardware companies without as much sales traction.

Hardware + Software = Less Commoditization

Most hardware products struggle with commoditization and low margins over time. Today’s connected hardware products are often a trojan horse for software. Software that is harder to replicate, can increase switching costs and provide more opportunities to interact with customers and build brand. The upshot is a higher customer lifetime value either through recurring revenue (Dropcam) or consumables (Kindle).

Takeaways

While the past few years have been banner years for venture capital investment, the connected hardware ecosystem has seen particularly explosive growth in both the number of startups and the receptiveness of VCs to funding them. This is driven by decreased development costs, shorter time to market, and a shift in hardware business models away from commoditized consumer electronics to recurring revenue and software services.

2015 is on track to surpass 2014 in both number of funding rounds and aggregate investment although growth is leveling off as a number of hardware categories become saturated and the ecosystem figures out who the winners are. As the hardware community evolves, there are a number of sectors where we’d love to see more hardware startups working. If you’re thinking about the intersection of hardware and software and looking for investment, upload a deck at www.bolt.io/pitch. We’ll reply back, usually the same day.

Notes:

- Thanks to Crunchbase for help with the data set. Actual dollars invested are higher as crunchbase and public data tends to not capture all fundings, especially early stage ones. Here’s a list of companies I included in the sample (threshold was $1M raised publicly). I also know of a number of hardware startups that have raised more than 1M but haven’t announced it publicly so I didn’t include them. I also included a number of companies who were acquired, acquihired, or failed in the venture portfolio map for completeness.

- Everyone’s definition of hardware is a bit different. Generally I’m referring to connected device startups who focus on both hardware and software. Robotics, wearables, and IOT companies fit this definition. Most consumer goods companies do not. We think of consumer goods companies like Casper, Warby Parker or Bonobos less as hardware companies and more as digital commerce brands innovating around distribution.

- There are a number of accelerator programs that are focused on or open to hardware that I didn’t cover in this post (which was just on traditional investors). These include Y Combinator, Hax, Highway1, Alphalab Gear, Qualcomm Robotics, and other Techstars programs. Also worth mentioning is Hardware Club from Paris.

- Big thanks to Bolt’s awesome intern Matt Dunn for helping with the infographic

Bolt invests at the intersection of the digital and physical world.