In previous years, we’ve published an infographic of the most active investors in hardware. This year, we’re trying something new and publishing a more comprehensive spreadsheet, along with a primer video on raising early stage venture funding. If you’re working on a business that includes hardware and thinking about raising venture capital, check out the video and spreadsheet below. For more context on recent hardware startup investment trends, see a breakdown here.

Venture funding primer for early stage hardware startups

Video run time: 20 minutes. Download a pdf of this talk here or download the video here.

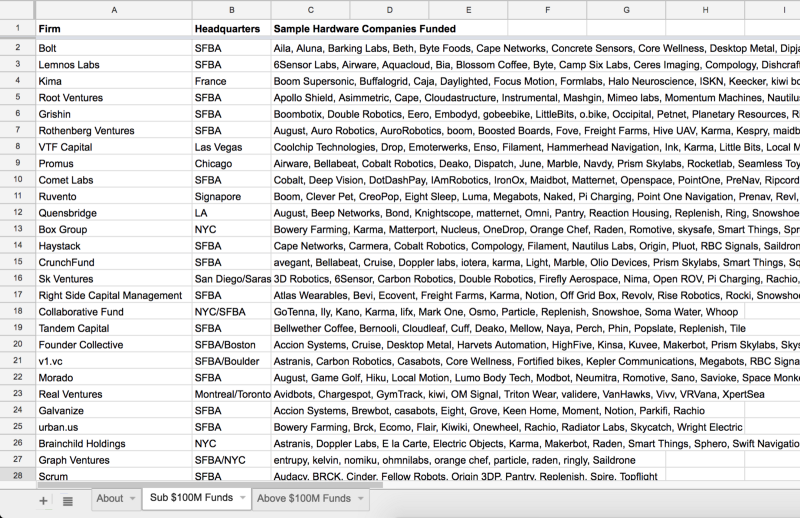

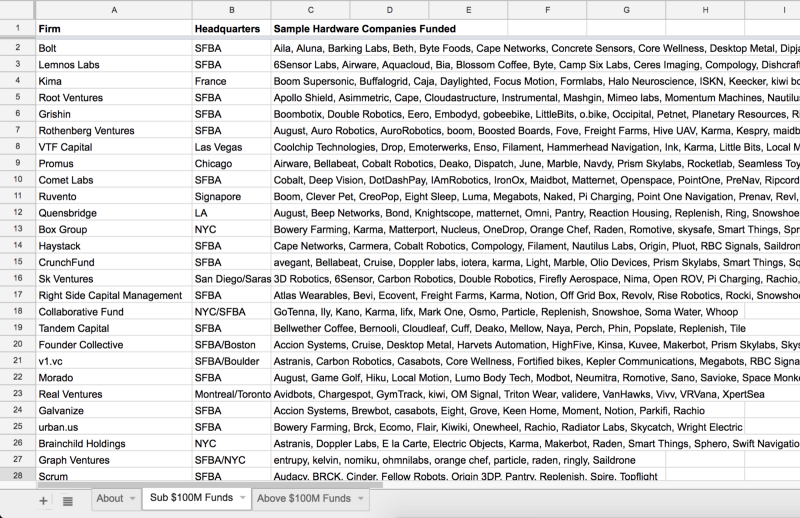

The Most Active Hardware Startup Investors

Each spreadsheet is ranked in rough order by number of investments in hardware. Note that a venture firm’s number of hardware investments isn’t always indicative of their focus on the sector. For example, A16Z has done 50% more hardware deals than Lux Capital. However, we’d classify less than 8% of A16Z’s portfolio as “hardware” but over 25% of Lux Capital’s deals as such. Criteria for inclusion on this list is greater than five investments we’d consider “hardware”. This is by no means a definitive list, but we hope highlights some of the most active investors in the category

I’m sure we’ve missed a number of funds. If you’d like to be added to this spreadsheet, please fill out this form or drop me a note. Also, there are a number of other great fundraising spreadsheets. See: VC Funds below 200M (credit: Shai Goldman), Investors in Europe (credit: Techstars), NYC VC Finder (credit: Bloomberg Beta), LA/Socal Investors (credit: Greg Bettinelli)

Bolt invests at the intersection of the digital and physical world.