Understanding the nuances between VC firms will make it easier to raise money.

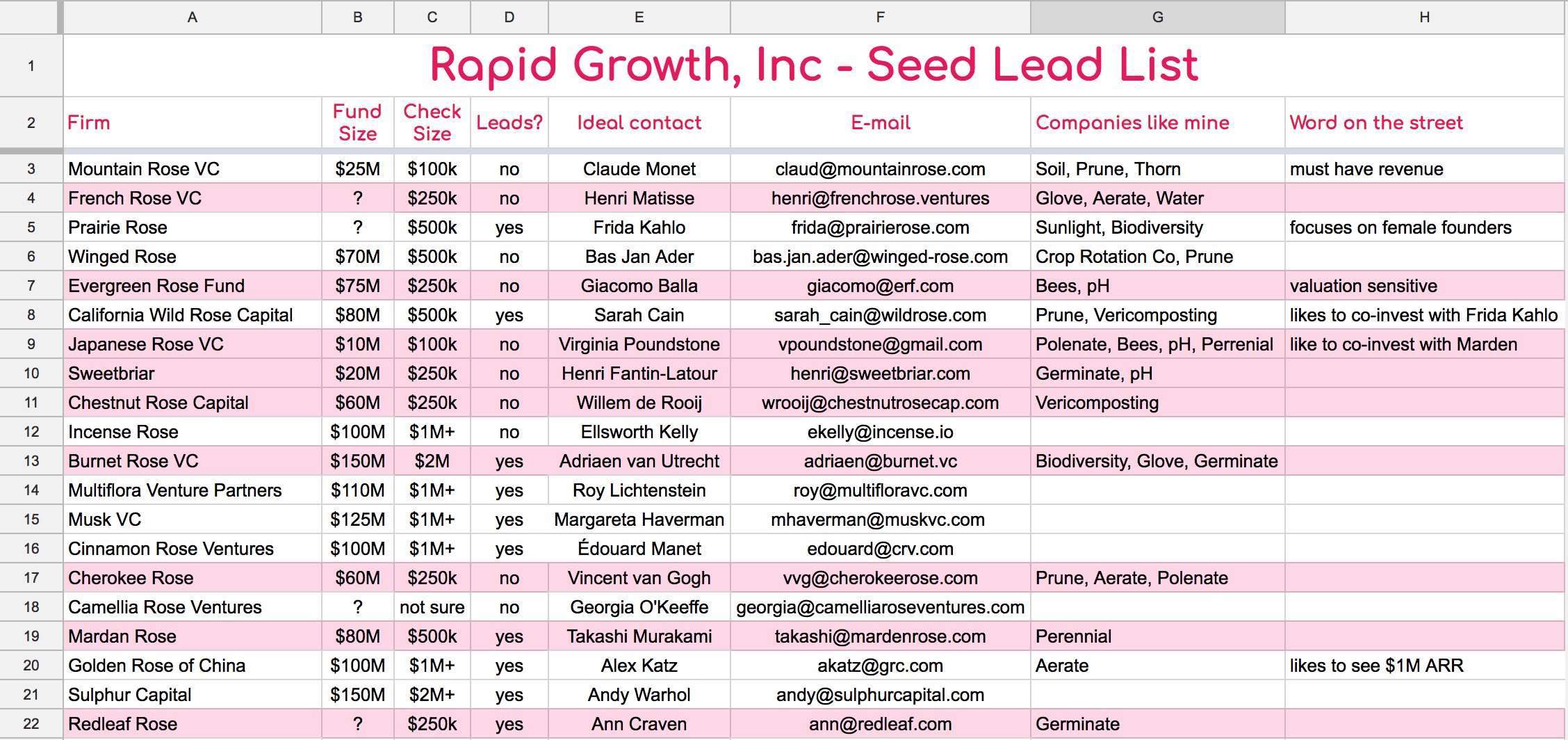

A great lead list starts with a good template. I built this one for you.

Gertrude Stein, mother of Dada and general literary badass, famously wrote, “Rose is a rose is a rose is a rose.” One of poetry’s great strengths is its ability to hold multiple truths in one word, as Stein does here.* All roses are roses, just as all VCs are VCs. But anyone who has walked into a rose garden — or into a VC’s boardroom — knows that a rose is not just a rose. There are over one hundred species of roses and at least as many different types of venture capital firms, let alone investors.

For a successful fundraise, you need to know to whom you’re talking before you get introduced. There are over 300 VC firms focused on seed stage, not to mention an infinite number of angel investors you might approach to participate in a funding round. Multiply that by the handful of meetings to get to a yes—or, more likely, a no, and you can essentially pitch investors ad infinitum without raising any money. Avoid this by building a robust lead list that is specifically tailored to your company.

First, know thyself

I f you can figure out which investors are actively seeking out companies like yours, pitch meetings will be more fruitful. Every VC is looking for a (1) a great team in a (2) a big market with a (3) a strong business model and (4) a competitive moat. Firms often focus on a particular subset of the above, following a strategy they articulated to their Limited Partners (LPs) when they raised their fund. This subset is defined by the intersection of a few of the following characteristics:

- Sector: Some funds focus on a particular vertical. Rock Health, for example, focuses on digital health, whereas Brick and Mortar focuses on the construction space.

- Customer type: Are you B2B or B2C? Some firms, like Maveron, invest only in consumer. Others, like SaaStr Fund, invest only in enterprise. Many firms do both, but they may have certain partners focused on one or the other.

- Revenue: Some investors only invest in companies with revenue and may have specific ARR or MRR benchmarks. Others (like Bolt) will invest pre-revenue.

- Shipping: For hardware companies, a shipping product mitigates major risk around your company’s ability to deliver a product that works. Many investors are okay with a hardware company being pre-revenue/launch but want to see manufacturing meaningfully de-risked.

- Demographics: Most U.S.-based firms only invest in U.S. based companies, or companies targeting the U.S. as their primary market. Unless a fund explicitly states they invest outside the U.S., they are unlikely to do so. Some firms, like Unshackled, specifically target immigrant founders, while others, like Brooklyn Bridge Ventures, only invest in their local ecosystem. There are also a number of firms emerging, like Backstage Capital, to invest in underrepresented minorities in tech.

- Category: Some firms focus on a particular category of company. For example, Wave invests only in marketplaces, while Lemnos invests only in hardware. Both firms will do both B2B and B2C, as long as the company fits the category (and is awesome).

Fill the funnel

Once you have defined yourself based on the above axes, identify other funded startups with similar attributes and the firms who funded them. VCs typically won’t invest in two direct competitors, so that would disqualify you from consideration.

There are a number of public lists out there to help. Here are a few good ones:

- The most active hardware investors, by Chris Quintero and me, at Bolt

- VC Funds below 200M, by Shai Goldman of SVB

- Investors in Europe, by Techstars

- NYC VC Finder, by Bloomberg Beta

- LA/Socal Investors, by Greg Bettinelli of Upfront

Narrow your fundraising lead list

Here are the major pieces of information that matter when narrowing firms you should approach.

Fund size

Founders raising pre-seed or early seed funding should generally look for investors from firms operating out of sub-$100m funds. Founders raising late seed or Series A should generally look for a lead investor who operates out of a fund greater than $100m.

This is because fund size generally correlates with check size. There isn’t an infinite supply of investable companies out there, so larger funds need to write larger checks in order to invest all that cash. This causes larger funds to move “up the stack,” investing larger amounts of money later in a company’s journey. Many large firms have small seed practices where they will write small checks into seed rounds (often $100k), but it’s not typically the focus of the firm. (Foundry is a notable exception)

Fund size is easily searchable on CrunchBase. I also highly recommend subscribing to StrictlyVC, which is the best source for knowing who’s funding whom, including at the LP/firm level.

Check size

There is a large variance in average check size between VC firms investing at seed. Some typically invest as little as $100k, whereas others will invest no less than $1m in a given round. This information is crucial for when you approach that firm. If, for example, you tell a partner who writes minimum $1m checks that you are raising $750k and have half the round committed, she is not going to pat you on the back. She is going to wonder why the hell you are in her office.

Check size helps you understand which firms might be competitive, and which firms might be complimentary. As firms begin to give you an indication of whether or not they might participate, average check size will help you put the puzzle pieces together and see which ones might not fit in the emerging picture.

Lead or no lead

For larger seed rounds ($2m+), a lead investor typically writes a check for roughly half or more of the total round. They will issue a term sheet for an equity round and run point on the legal negotiation on behalf of the syndicate of investors following them. It’s common for them to take a board seat.

In smaller rounds ($1m or so), a lead investor might best be described as an investor without commitment issues. They are willing to “say yes” and set terms on a convertible note or SAFE that others pile in on at their own pace. Precursor and Bolt are great examples of firms like this.

If the firm does neither of the above, they are not a potential lead. They will likely give you a “soft commit,” or a yes contingent on a lead setting the terms for the round.

Ideal person to talk to

Some firms invest in many sectors, and you may find that a single partner has done most, or even all, of the investments in your company’s vertical. You want to talk to that person.

You can dig up this information by checking each partner’s LinkedIn profile; many VCs list their board seats there. They may also be listed in the partner’s bio on the firm’s website or be evidenced by their educational and company building background. You may have to do your own legwork here, because the databases out there, such as Crunchbase, tend to have mediocre data at this level of granularity.

Word on the street

Funded founders and junior investment professionals in the ecosystem often have nuanced information about how firms and investors operate and their interests. If you have these people in your networks, talk to them. If not, follow the VCs on Twitter and read their blog posts. Podcasts are also great. The Twenty Minute VC is an especially succinct introduction into how some wonderful investors think and where they are looking to invest.

All of this information is power. It will help you figure out the best strategy for fundraising and fuel an efficient process. You can use the lead list as the basis for your actual fundraising process or as the jumping off point for running that process through a CRM like Streak. Whatever strategy you employ, make fundraising easier by starting with a robust lead list designed for your company. Hopefully this template helps.

*This snippet appears in Stein’s 1913 poem, “Sacred Emily.” It’s more complex than the extremely brief reading provided above. For example, the first “Rose” likely refers to a person named Rose. Stein often lived in the presentation and representation of words, names, and identities, in both metaphor and metonym. Since this is a blog post about finance, not poetry, I let the top note carry it. If you’re interested, check out Gertrude Stein and the Making of Literature.

Bolt invests at the intersection of the digital and physical world.