We’re in the middle of a hardware renaissance. By my count, over 400 venture funded hardware startups have gotten started in the past 5 years. To be sure, there have been some stumbles. Last year saw the public failures of Coin, Skully, and Pebble and the continued struggles of GoPro and Jawbone. When I talk about hardware, many people assume we’re investing in businesses that focus on one-off product sales like these. We’re not.

It’s great that 3D printing, systems on a chip, and crowdfunding have democratized creation, but the side effect of lower barriers to entry is even more competition. It’s easier than ever to launch a hardware product but more difficult than ever to build a sustainable business. These days, products are getting commoditized in real time!

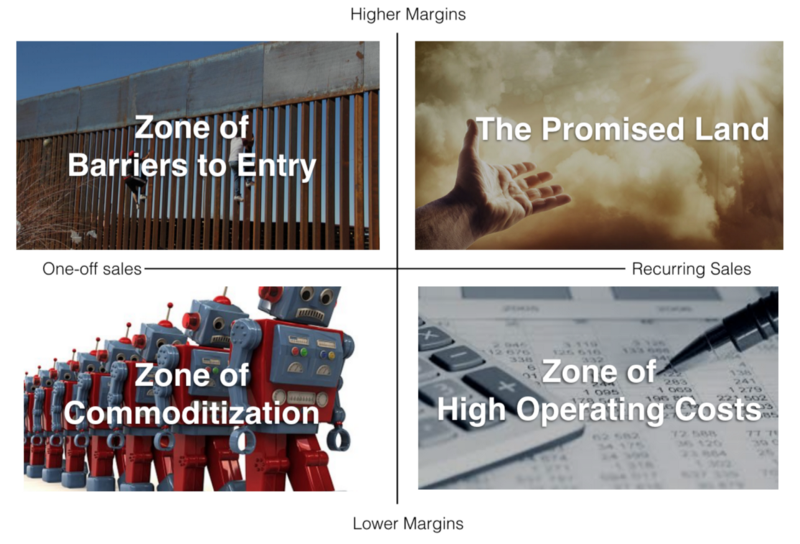

But, just as connectivity and the cloud transformed one-off sale software products into the SaaS industry, many one-off sale hardware companies now have the potential to build recurring revenue into their businesses. This isn’t appropriate in all product categories, but where possible, businesses driven by recurring revenue tend to be superior to those that aren’t. Let’s look at how a hardware company’s mix of recurring revenue and margins affect their strategy.

Zone of Commoditization

Most traditional consumer electronics companies operate in highly commoditized markets (think TVs, computer peripherals, and appliances). These businesses are driven by one-off sales at fairly low margins. Jawbone’s struggles are endemic to this space. They brought category defining products to market (bluetooth headsets and speakers) only to have competition destroy their margins. Companies succeed only by constantly churning out new products and having the largest economies of scale. As 3DR learned in their fight with DJI, this is not a fun place to be. The zone of commoditization is a black hole. Markets exert tremendous pressure, dragging companies towards lower margins and fewer recurring sales over time.

Zone of Barriers to Entry

To be clear, it’s still possible to make lots of money in businesses driven by one-off sales. Companies achieve this by creating high barriers to entry, typically via brand and technology. You’re susceptible to commoditization over time and market saturation if consumers don’t need to upgrade regularly (think GoPro) but depending on how long you can remain differentiated there may be a good businesses to be built. Fitbit currently operates here. They’re trying hard to increase revenue from subscriptions but it’s currently a very small fraction of the business.

Zone of High Operating Costs

Some B2B companies like Square or Sigfox are driven almost completely by recurring revenue, but high customer acquisition or service delivery costs keep net margins low. There aren’t many hardware companies in this category because recurring revenue is typically high margin and, unlike pure SaaS businesses, upfront hardware purchases usually let you recoup your customer acquisition cost immediately rather than over time.

The Promised Land

The only thing investors like better than high margin revenue is predictable future revenue. The problem with one-off sales is that revenue can dry up overnight whereas recurring revenue typically has a much longer tail. Even if all future customers buy a competitor’s product tomorrow, it’s still possible to provide services or consumables to an existing customer base. Also, recurring revenue can make one-off sale businesses operating in smaller markets venture fundable. At equivalent growth rates, the enterprise-value-to-revenue multiple on a business with pure recurring rather than one-off sales can be 2–3x! Consumables businesses (like Keurig or Formlabs) have seen success here along with a number of connected camera companies that offer paid video storage (Canary, Dropcam, Ring). Peloton is also doing super well. They sell an exercise bike + $39/month for live streamed cycle classes and did $170M revenue last year.

Many hardware products shouldn’t have a service component or even be connected to the internet (cc: Internet of Shit) but generally, the stronger the recurring revenue story, the more interesting a business is to investors. We’re excited by hardware because, until we live in the Matrix, we still need physical technology to interface with the world. As many major software companies have figured out, if you want to acquire customers onto a software platform, you may want to build your own hardware (cc: Amazon Alexa, Microsoft Surface, Google Pixel, Snap Spectacles). Over the last few years, shipping that physical component has gotten cheaper and easier. On the flipside, building a company that can fend off commoditization is now harder than ever. By incorporating recurring revenue into your product where possible, you help ensure that, should you build a successful hardware businesses, you can remain one.

Bolt invests at the intersection of the digital and physical world.