I always find more truth about a company’s future buried in a company’s products. Long story short: I don’t have high hopes for Sonos’ trajectory. Here is why…

For eight years, a war has been raging among a number of unlikely players. This bloodless technology battle is turning out to be one of the fiercest and most expensive we’ve seen in decades. The prize is one of the most sought-after commodities in the world: access to tens of millions of homes. It all starts with a 100-year-old invention: speakers.

The reason this battle matters is that it reflects a huge change in consumer behavior. Until recently, there were very few pipes into the home: Telecom companies like Comcast and AT&T that provided a paid monthly service.

A few years ago, modern technology companies discovered how easily consumers could be convinced to allow much deeper access, without the cost of providing a paid service. Voice-controlled speakers from the likes of Amazon, Apple, and Google have struck a deep nerve with consumers, thanks to consumers’ frustration with tech-enabled devices that have too many apps, interfaces, buttons, and controls. The first big wave of these devices has been wildly commercially successful.

Hidden in plain sight is the roadmap for how this battle for consumers’ homes is likely to play out.

It is too early to tell if this tradeoff is a net positive for consumers, but it’s clearly a massive boon to technology companies’ bottom lines. Sonos, the first startup company to widely deploy this technology, is going public with a placeholder amount of $100M.

Despite all the analyst reports, market speculation, and journalists poring over the Sonos S-1 filing, I always find more truth about a company’s future buried in the plastic and the electronics that make up the products themselves. Hidden in plain sight is the roadmap for how this battle for consumers’ homes is likely to play out.

Two Categories and Two Teardowns

There are two distinct categories of players in the voice-controlled battle for the home. In the blue corner: big tech companies that want to gather more data about consumers to further their core business. In the red corner: more traditional speaker manufactures that need to add more intelligence, in order to keep up with consumer expectations. To really understand the players, we have to peek inside products from each. I’ve chosen the flagship products of the leading companies in each of these two camps: Amazon Echo Plus and Sonos One.

Even though just about every decision that was made about each of these products’ hardware was different, they use the same backend Alexa service (where most of the IP is) from Amazon. These two products are clearly targeted for the same consumers and represent “mid-level” smart speaker features.

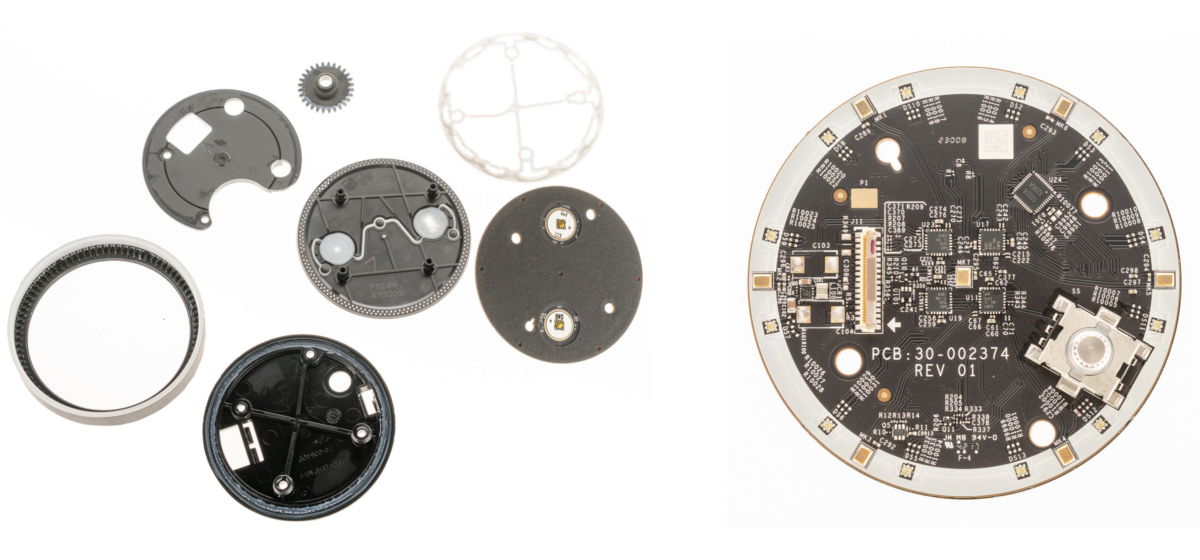

Teardown: Sonos One

The Sonos One speaker is the flagship smart Alexa-enabled speaker. Sonos is hoping it will boost the the trajectory of the 15-year-old speaker company. With an MSRP of $199, it’s $50 more expensive than the Echo Plus. Some might think the price differential is due to more expensive components or better sound quality, but I have another take: I believe it’s a sign of a struggling speaker company in an impossible war.

Carefully removing the bottom cover, we see the first signs of a speaker company: part numbers and careful coding everywhere. There are different part numbers for black and white parts in the tool, shot date of September 2017, Revision D of this part, and a “PC,” which means this polymer is 100% polycarbonate (a somewhat rare and more expensive choice). This level of detail shows a company that runs an extensive supply chain.

Digging a bit deeper, we see traditional design and manufacturing processes for pretty much everything. As an example, the speaker grill is a flat sheet of steel that’s stamped, rolled into a rounded square, welded, seams ground smooth, and then powder coated black. While the part does look nice, there’s no innovation going on here.

After removing all the speaker components, the complexity of the main body comes into view. This is actually two separate parts that are glued together and the seam ground smooth. This is a design we used to call a “block and chisel,” where you start with one big shape and “cut away” plastic to make components fit. It would be impossible to mold this part as a single piece. It’s possible this is a common manufacturing process to increase sound quality while still remaining cost-competitive with higher-end speaker cabinets. The polymer used is ABS + 10% glass fiber, which is quite unusual for traditional consumer electronic products but is a likely addition to improve sound quality. Glass fibers cost more, are harder to design tooling for, and create poor surface finishes (but provide great mechanical properties in exchange).

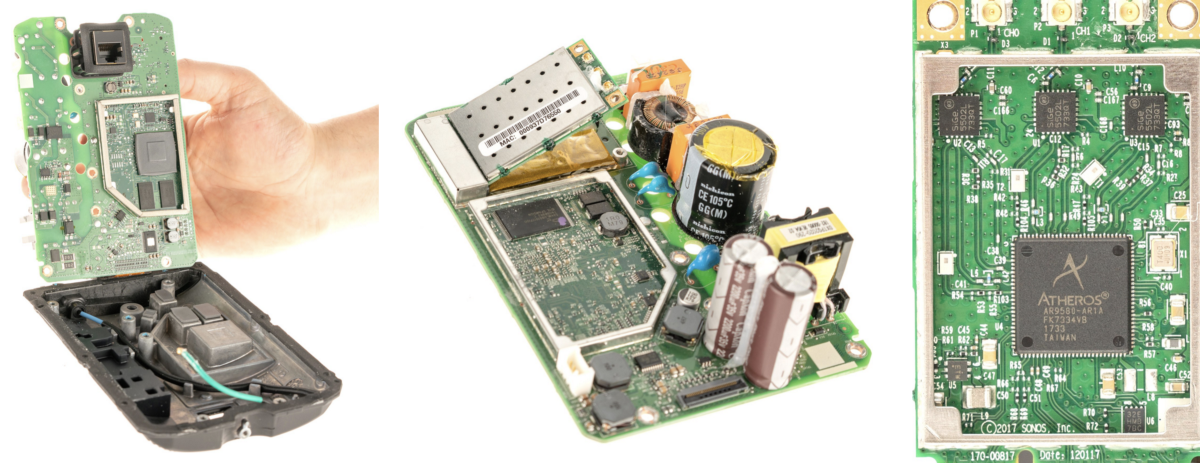

Turning our attention to the main circuit board, there’s more evidence of a speaker company tacking on some technology. The power supply (electronically dirty, analog circuitry) is on the same board as the communications, MCU, and audio output (digital, clean circuitry). In most products I’ve worked on, these are often separated into to two separate boards. While it’s always dangerous to guess, this is likely common in all Sonos speaker hardware to minimize the number of circuit boards that must be manufactured and installed into the cabinet.

You’ll also notice all the communications are on a separate PCI Express module (which is made by Sonos but designed around Atheros’ AR9580-AR1A chipset). Putting communications on a separate module is a commonly used technique with large companies to standardize radios across a broad number of products and simplifying the FCC certification process. Another supply chain trick and symptom of a company with a broad array of similar products.

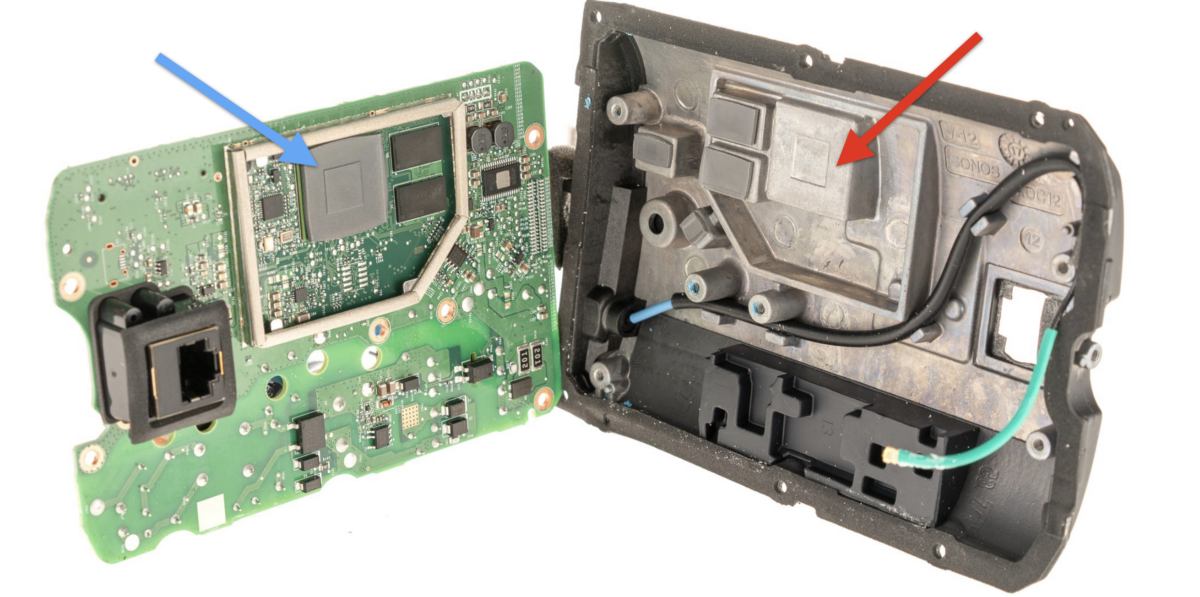

Taking a careful look at the heaviest part in the product: the rear panel is die cast zinc and serves as the primary heat sink for the product. Notice the lineup of the primary processors on the circuit board (blue arrow) and their matching surfaces on the zinc part (red arrow). This means lots of heat is being generated by the microprocessors and flash. We see:

- Freescale NXP SoM SC667517EYM10AE

- Cypress NAND Flash 8Gb S34ML08G101TFI000

- Micron DDR3 Memory 4Gb (2x) MT41K256M16TW-107-P

If you are familiar with consumer electronics, you’ll note these are some sophisticated — and expensive — parts for a speaker. This is common with smart speakers because they need to store lots of data on the device and quickly process complex audio signals.

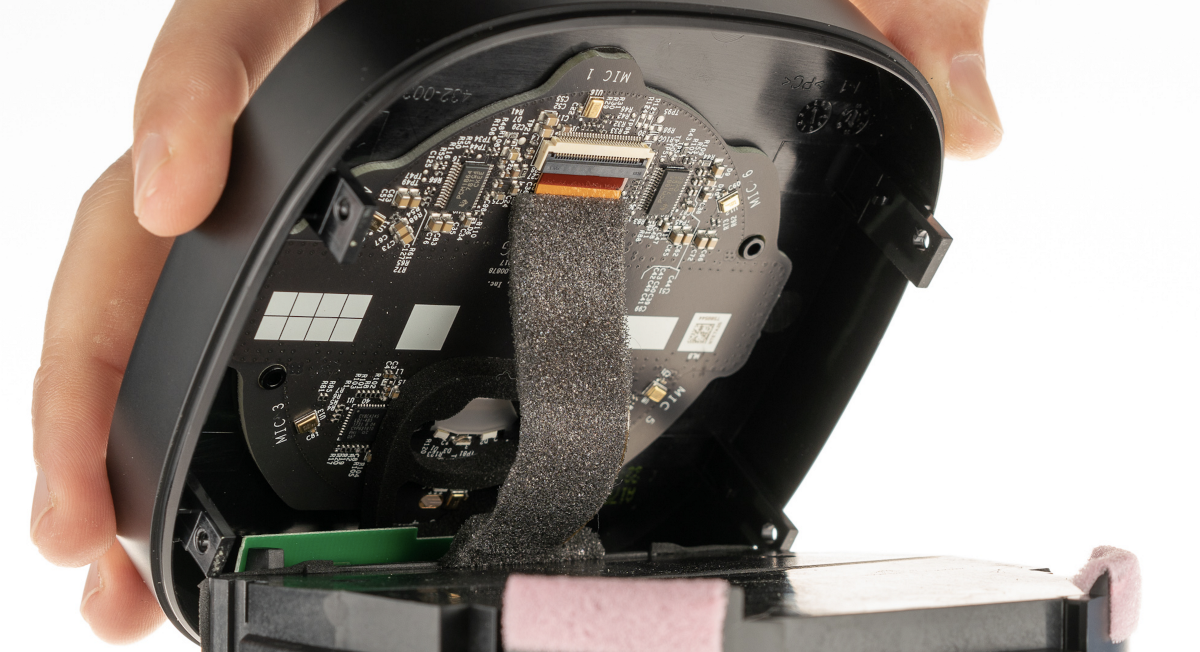

Looking upwards to the top of the speaker, we find the microphone array, audio processing circuitry, and all related buttons and LEDs for the UI. This board looks to be designed by a very different team/person (possibly even outsourced) from the power and communications board. There are 6x MEMs microphones equally spaced joined by 2x TI PCM1864 audio 4-channel front-end ADCs. The digitized audio information is then beamed down a ribbon cable to the power and processor board we looked at earlier, eventually to make its way to Amazon’s Alexa backend.

Now that our shiny new Sonos One is in pieces on the table, let’s turn our attention to Amazon’s flagship competing product.

Teardown: Amazon’s Echo Plus

Amazon was the first company to popularize the smart speaker concept. The Seattle giant’s first foray into speakers has been shockingly successful (selling tens of millions of units to date). While the revenue generated by Echo is a tiny fraction of Amazon’s top line, every detail about the implementation of the product signals a company spearheading a new product category and a business model that doesn’t depend on profitably selling consumer electronics hardware.

This is clearly an extremely unusual way to design a speaker.

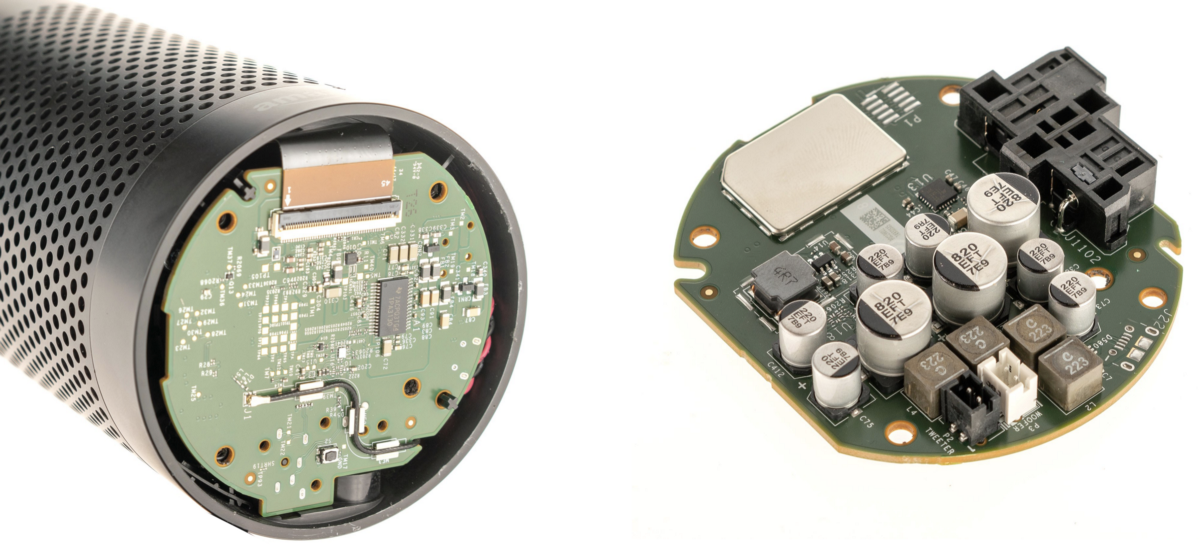

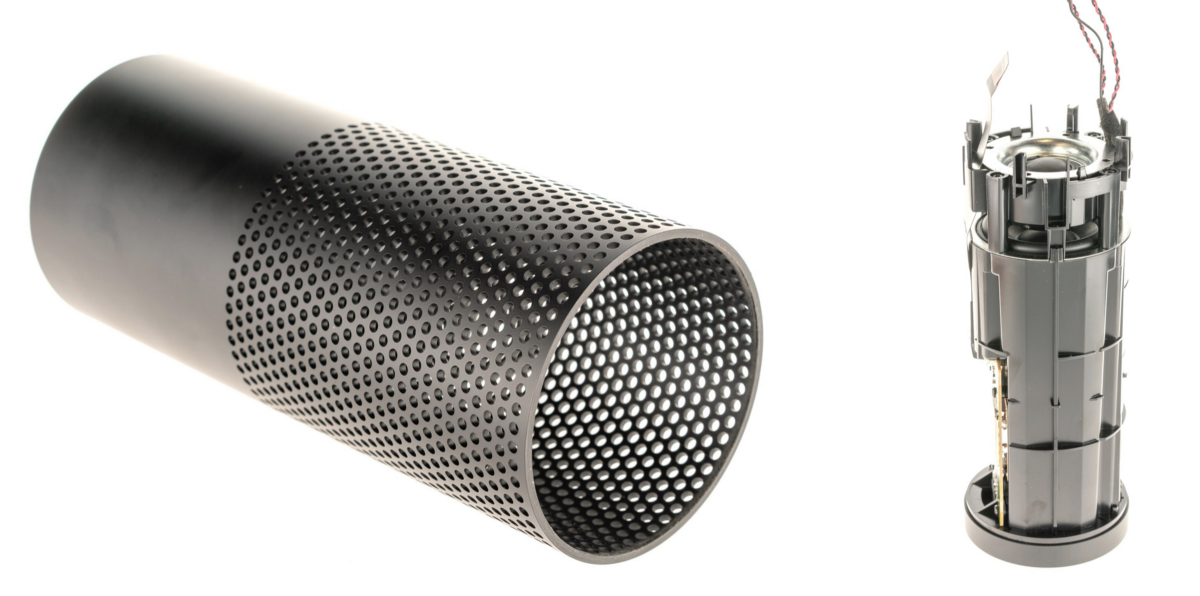

From the very first part I looked at, it became clear Amazon did not design Echo like a traditional speaker. The entire product is assembled like a tubular plastic sandwich, with all components connected vertically around a central axis (we engineers call this a stack-up). It’s an extremely unusual way to design a speaker.

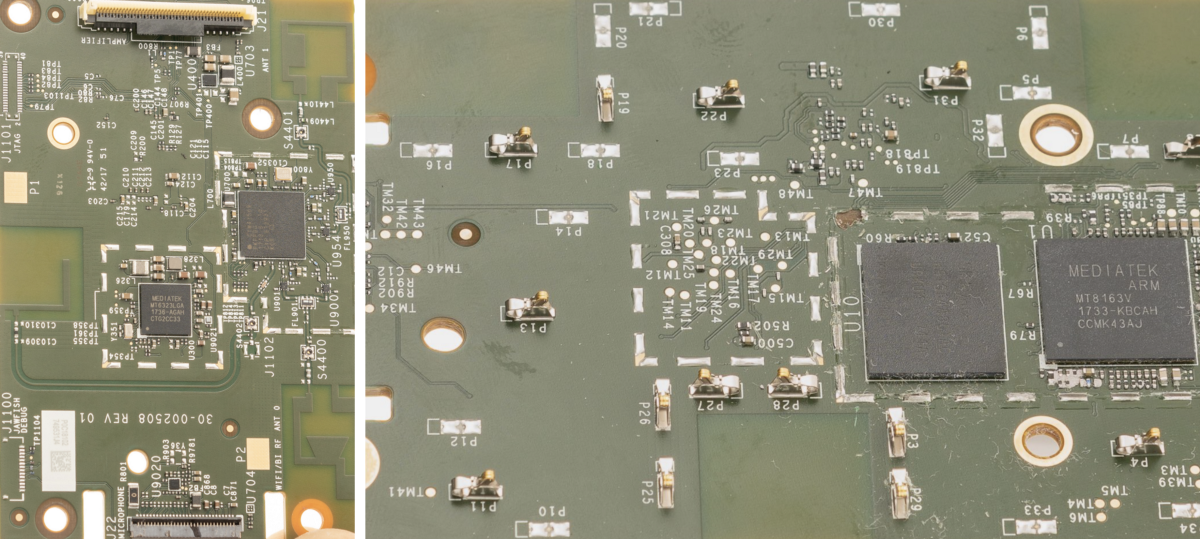

After peeling off the first plastic part in the stack-up, we see the audio and Bluetooth board. The bottom of this board handles the digital circuitry for generating and manipulating the audio signal, while the top is the amplifier, power input connector, audio out connector, and EFR32MG12 Bluetooth chipset (EFR32MG12P232F1024GM48 — say that three times fast). The EFR32MG12 has a configurable sub-GHz radio programmed for the Zigbee home network protocol, which is one of several future low-power, IoT home networking standards. This is yet another clue that Amazon is thinking about Echo as a gateway to the home, rather than a speaker with some new tricks.

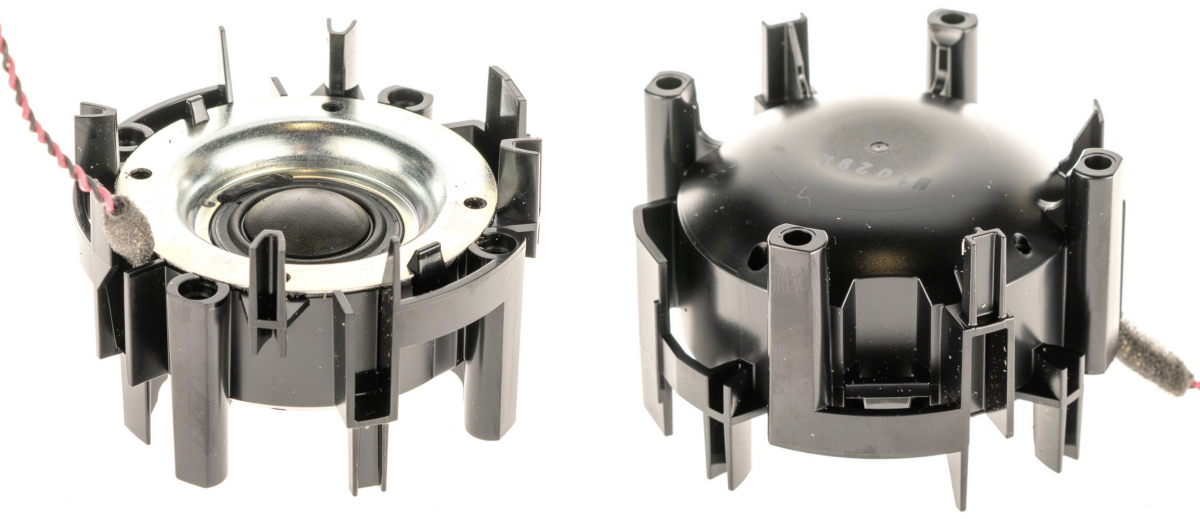

Peeling off the next layer in the stack-up, we see the tweeter, which plays the high-frequency spectrum. Both the tweeter and midrange drivers are downward firing, which again is quite rare for consumer electronics speakers but a near necessity for the cylindrical design. A few interesting notes about this bottom speaker “reflector” part to the right in the above photos:

- This part is extremely complex for such a simple functional part. There are a surprising number of ribs, undercuts, and bizarre geometry not often found in consumer electronics parts.

- The external surface has no draft (meaning the wall has no angle). Draft is a required feature of nearly every injection molded part, so this part is actually two parts (the inner/upper part is injection molded, and the outer surface is extruded or machined). Again, a very unusual decision that is both beautiful and expensive.

- This conical reflector + outer surface part is easily 3–5x more expensive than I would have guessed from the outset.

Pulling off the sleek speaker grille, there’s a shocking secret here: This is an extruded plastic tube with a secondary rotational drilling operation. In my many years of tearing apart consumer electronics products, I’ve never seen a high-volume plastic part with this kind of process. After some quick math on the production timelines, my guess is there’s a multi-headed drill and a rotational axis to create all those holes. CNC drilling each hole individually would take an extremely long time. If anyone has more insight into how a part like this is made, I’d love to see it! Bottom line: This is another surprisingly expensive part.

Next in the stack: the tweeter “carrier.” Not a ton to see here, other than another surprisingly complex part. As one of my old mechanical engineering professors always said, “plastic is free,” so this relatively standard part likely doesn’t add much cost, even though it looks bizarre.

As successive layers of the stack are removed, it’s starting to become painfully clear that Amazon is spending far more to produce this speaker than I initially guessed. This primary structural part (where the main circuit board is mounted and which holds the mid-range driver) is, again, wildly complex. Looking at the draft angle (blue arrow and dotted lines), we know this part is pulled out of the injection mold tool vertically, which is both expensive and fraught with design constraints. Why Amazon decided to mold the part this way is beyond me. It also strikes me as unusual to place the heavier driver (the midrange) above the tweeter. Usually, speakers are designed with the heaviest magnets as close to the bottom of the product as possible for stability.

The main PCB sits at the center of the product and is loaded with Mediatek parts (moving away from TI in the first generation Echo product line). A few of the major chipsets:

- Mediatek MT8163V is the primary microcomputer/processor, similar to one you’d find in a tablet PC. It’s a shockingly sophisticated 1.5GHz quad-core processor with built-in graphics, DDR3 memory, WiFi, Bluetooth, camera capability, GPS, FM radio, etc. Interestingly, this is the same system-on-a-chip used in the 6th generation Amazon Fire HD; maybe Amazon had a few extra laying around? (Sorry, Bezos…)

- Mediatek MT6323LGA power management chipset

- Cypress/Broadcom CYW43569PKFFBG 5G WiFi radio with Bluetooth (yes, a second bluetooth radio)

- SK Hynx H9TQ64A8GTAC DDR3 Flash memory

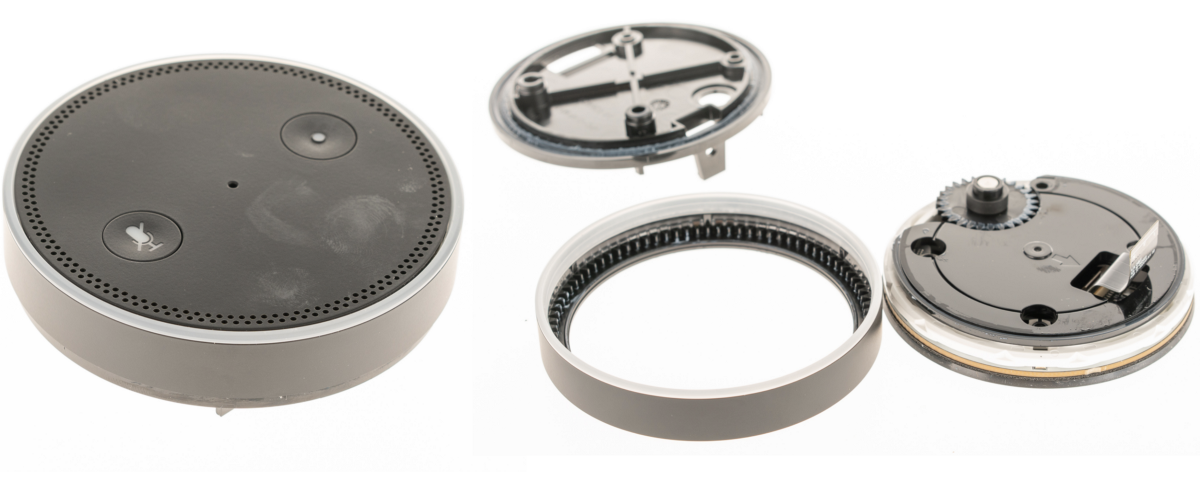

And finally, in the last layer of the stack (and the top of the product), we have the volume control, two pushbuttons, and microphone array/user-interface PCB. The volume control is an incredibly creative assembly built around a continuous rotation potentiometer, an elegant round light pipe, and custom gearing in the volume ring. It is nothing particularly expensive or complex, but it’s a very neat design.

Pulling the user-interface assembly completely apart, we see how many parts it takes to build a custom volume control. Again, Amazon is willing to spend real money to build something interesting and differentiated. There are eight custom-molded parts that come together for the volume knob, a very different story than the single part and capacitive sensors for the Sonos One.

On the microphone PCB, we find seven microphones (one more than the Sonos, the extra being in the center of the board likely for directionality) and 12 LEDs that display the volume and approximate location of the user’s voice. I’ve always loved the light display on the Echo line of products, but I’m curious why the LEDs aren’t equally spaced (maybe for more specific directionality around the mics?)

Innovative Tech Giant vs. Speaker Company

Despite these two products serving nearly an identical purpose, they couldn’t be more different from each other in terms of design intent. After carefully dissecting them both, it’s clear Sonos only buys into the smart speaker category because they have to, in order to compete with others. Amazon has spent significantly more on their bill of materials (BOM) cost for a lower sticker price speaker vs. the Sonos One.

Amazon has three wildly unfair advantages, which doesn’t bode well for Sonos’ IPO.

Part of this is due to Amazon being both the OEM and the retailer (no margins on each sale), but a big portion is Amazon’s clear long-term thinking to dominate this nascent market. It is always tricky to estimate BOM cost without diligently researching each custom part and purchased component, but my suspicion is that despite the 25% lower price tag, the Echo Plus is about 15–20% more expensive than the more premium Sonos One. Amazon has three wildly unfair advantages:

Amazon’s Unfair Advantage #1: Retailer and OEM

Amazon sells nearly all of its Echo products through their own retail channel, which means they don’t pay a margin to other retailers. I can’t think of a single consumer electronics company that sells tens of millions of units nearly exclusively, directly to consumers like that. In practical terms, it means 35–50% of the product’s price that the retailer typically takes can be directed to make a better product.

Sonos, on the other hand, has to pay this cost to retailers (including Amazon!) This is the primary driver for Amazon’s product being both more expensive to manufacture and cheaper to buy. There’s simply no way to beat that strategy in a mass-market product category like speakers where price is one of the major deciding factors for consumers.

Amazon’s Unfair Advantage #2: Platform Ownership

Even though Sonos’ speaker has nearly identical Alexa functionality, 100% of the business leverage rests in Amazon’s control. The real IP and value is not in the metal and plastic that consumers are buying. It is in the software, data, and systems that Amazon is continually building.

We’ve already started to see this strategy play out, with nearly every product at CES 2018 bragging about “Alexa inside.” This is how platform leverage is built, and the individual nodes on the platform (like Sonos) are always dwarfed by the owner of the platform itself (Amazon).

Amazon’s Unfair Advantage #3: Diversification

Sonos’ speakers represent the full Sonos business and brand. As such, every dollar they make must come from selling physical products. As I’ve written about extensively, this is a tough business, and very few companies reach large scale ($1Bn+ of revenue) over multiple product cycles. Amazon, on the other hand, can easily lose billions of dollars on “side bets” like the speaker product line because their revenue is spread out across many other business units (AWS, retail, and Prime). This business model diversification makes it tough for companies like Sonos to compete because it’s not a zero-sum game for all.

Short or Long on Sonos?

As you may have gathered, I don’t have high hopes for Sonos’ trajectory. If the upstart was really set on embracing the next generation of consumer speakers, they would be rethinking how to build their audio products systematically from the ground up, to own as much of the platform as possible. But the products they’re shipping don’t tell that story: They show a traditional speaker manufacturer incrementally adding technology in an attempt to keep up with a fast-moving race. This is never a winning strategy in the long term.

Ben Einstein was one of the founders of Bolt. You can find him on LinkedIn.

Bolt invests at the intersection of the digital and physical world.