The best investors are more interested in how you think than what you know.

When I tell people Bolt invests in pre-product, pre-revenue companies, I often get a bewildered response: “But how do you know what to invest in?” That’s a great question, and one I ask myself quite often.

Bolt continues to seek founders earlier and earlier in their journey, often when their eventual companies are better described as ideas. We can’t invest in product-market fit because there is no product. We can’t invest in a de-risked customer acquisition funnel because there are no customers. So, in what — or really whom — are we investing?

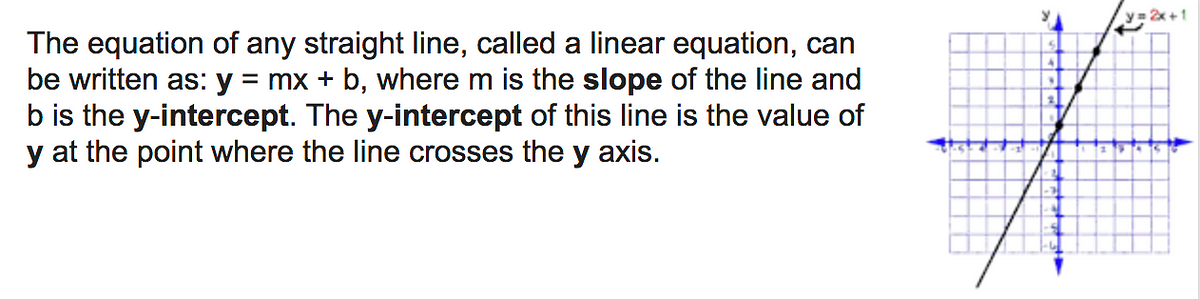

A year after joining Bolt, I asked Ben why he hired me. No MBA, no two years of management consulting, no engineering degree. He answered point-blank and without hesitation, “I hire for slope, not y-intercept.”

For those of you who missed that particular algebra lesson, here’s what Math.com has to say on the subject:

I’ve learned a lot about investing since then. You know, the kinds of things you can list on a proper resume: P&L statements, cap tables, and fund modeling; how to run a diligence process, negotiate deals, and manage board meetings. But the collective force of all those spreadsheets and all that paperwork cowers in the face of Ben’s simple lesson that night. It’s about slope, not y-intercept.

In a startup context, the metaphoric y-intercept describes the point at which you are meeting someone on their knowledge-collecting journey. To use gardening as an example: a person muddling their way through cultivating a garden for the first time has a low y-intercept. An expert who has been gardening for twenty years and could teach a course on grafting avocados has a high y-intercept. Slope describes the rate at which the person is growing their knowledge base and skills. If one wanted to pluck an ideal person to invest in from the proverbial pumpkin patch, that rare combination of a high y-intercept and steep slope would certainly be ideal, but these humans are few and far between. Of course, there are businesses where a lack of in-depth knowledge and profound domain-expertise is irreplaceable. For these industries, you’d be hard-pressed to raise money based on enthusiasm and high-speed learning alone.

Evaluating Slope

It’s relatively easy to assess y-intercept from a LinkedIn profile. Educational degrees and work experience relevant to the field in which you are starting your company often show that. The slope question is most interesting to me because it’s tougher to judge. I believe many investors over-index on accomplishment and under-index on potential. That leaves us with the complex algorithm of judgement to identify a founder’s slope. So, how do we do that?

I always want to see a company’s operating plan. Many founders we invest in have never made an operating plan before, let alone managed a company to one. Plus, as I’ve stated, the company is still usually an idea, so the plan is going to be constructed on assumptions, rather than reality.

An operating plan tells me a lot about how you’re conceptually planning to run the business. When looking at a plan, I am more interested in the general trends of the plan and how the numbers relate to one another than the specific digits sitting in individual cells of the spreadsheet. Are you optimizing around a couple of key full-timers or planning to lean heavily on consultants? Do you think it will take three months or three years to ship your product? Are you planning to run lean or ramp to a high burn quickly? How much cushion have you left to raise your next round of capital?

While working with a young team on a recent investment at Bolt, I received an ops plan that was difficult to parse. We did a quick call, and I mentioned a couple of big-bucket things for them to re-work. They listened, they got to work, and a week later, we had a new ops plan to work through. It was night and day from the first revision, but still a long cry from an A+ plan. Another round of feedback later, and they were coming back for more. While the current version still isn’t an A+ plan, the earnestness and speed with which the team processed the input and iterated on the plan is a sign of steep slope. This is a configuration with which I am always excited to work.

Customer-driven insights are another great sign of steep slope. If you’re still an undergrad, it stands to reason that it’s tough to have ten years of in-market experience. Ten years ago, you were busy being awkward at a middle school dance, not running growth marketing for the hottest startups in Silicon Valley. Great founders, however, test assumptions early and often.

When I start peeling back the assumptions around product, words like “when we interviewed thirty potential users” resonate more strongly than “because I read it in a report.” When I start to poke at customer acquisition numbers, referencing the dry marketing campaign you ran last month (however imperfect) is a stronger indicator than quoting industry averages you read in a blog post. Slope is, first and foremost, about doing.

I’ve seen a lot of advisors encourage founders to be over-prepared before pitching VCs. While I agree it’s important to know your numbers, I think this advice can create a lot of anxiety. If you don’t have an answer to an investors question, be transparent. Seek to understand why the question is important in the first place, and commit to finding the answer after the meeting. Engage in the conversation; don’t scramble for the answer.

The best investors are more interested in how you think than what you know.

Bolt invests at the intersection of the digital and physical world.