The best digitally native vertical brands (DNVBs) are evolving from direct to consumer enterprises to sophisticated omnichannel operations enabled by technology.

Madison Reed, a San Francisco-based women’s hair color company, is an instructive example of how startups are evolving to redefine consumer categories. Here are a few things I look for when investing in an early digitally native vertical brand (DNVB) startup, and how Madison Reed embodies them.

Founder market fit.

Every investor says that founder quality is everything, but the longer I’m in this business, the more I find it to be true: founder trumps all. Whether you think women’s hair color is compelling or not, Amy Errett is an undeniable force of nature. When someone like Amy walks in the door, you write her a check.

Amy was neither a hair care expert, nor did she have deep CPG experience prior to starting Madison Reed. She did, however, have a genuine connection with the problem space and a vision for how a her brand could evolve the cultural conversation around women’s hair color. When it comes to backing a DNVB team, a deep resonance and understanding of the customer is non-negotiable.

Product excellence is table stakes.

You can perform all the customer acquisition hijinks you want; without a stellar product, you won’t drive retention or evangelism. Without these two things, your company won’t get the necessary flywheel to grow. Madison Reed’s attention to clean labels, sustainability, and high performance set them up for success from the beginning.

When Madison Reed was founded in 2013, a tidal wave of consumer awareness was well underway: ingredients in our everyday products are slowly poisoning us and the planet. Madison Reed did the difficult work of making custom formulations and building out the supply chain to offer a product free of ammonia, PPD, resorcinol, parabens, phthalates, and gluten, without compromising on product performance. This created differentiation in the market and gave Madison Reed room to run ahead of the inevitable fast followers.

Most product categories don’t have the razor/razor blade dynamics.

Rapid refresh cycle and high stickiness drive customer lifetime value.

Everyone talks about razors and razor blades. The truth is, they should! Everyone dreams of the razor/razor blade dynamics of an up-front product that locks consumers into a must-have, high-margin, widget that deteriorates rapidly. This recipe for LTV is one reason the Razor Wars continue to rage, with players like Harry’s/Flamingo, Billy, Bevel, and Supply continuing to fight for our hair removal mind share in a post-Dollar Shave Club world. While many CPG and DNVB brands claim to be “Dollar Shave Club for X,” few have those dynamics.

Madison Reed does.

Madison Reed focused on 35+ year old women who are dying their hair to maintain a “natural look” and cover grays. If a woman finds a hair color she loves, she is likely to stick with it, so she can communicate that consistent, natural look. This creates an incentive to stay with a brand, and even a specific SKU, that she knows works for her. Even if she wants to switch the look, natural hair growth causes those roots to pop every 4–6 weeks, creating a natural cue to re-color, and thus re-order.

“Hair color is a category that’s highly overlooked,” says Errett. “It seems like, who cares about hair color, right? But the size of the prize is massive, and it’s got these elements to it that are very attractive because repetition is built into the usage pattern. So I think what I saw was an opportunity to disrupt a huge category that no one was paying attention to.”

These category dynamics lead to lower churn, and higher customer lifetime value (LTV). A higher LTV enables companies more room with customer acquisition cost (CAC), and to acquire customers a higher rate. When investors see a great LTV-to-CAC ratio, that’s when we get excited and want to put more money in.

Broad, logical product universes drive AOV.

Madison Reed started with a hero product that addressed a major gap in the market: non-toxic hair dye. They wasted no time bolstering their product offering with everything from Root Reboot kits to hair dying accessories like smocks and combs. This gives customers the opportunity to get everything they need in one place and drives average order value (AOV) up in a way that feels logical to the consumer.

Technology as a core competency.

Stodgy market incumbents (like L’Oreal, in this case) struggle to leverage technology efficiently and creatively. The best contemporary DNVB brands have technology as a core competency, not an afterthought.

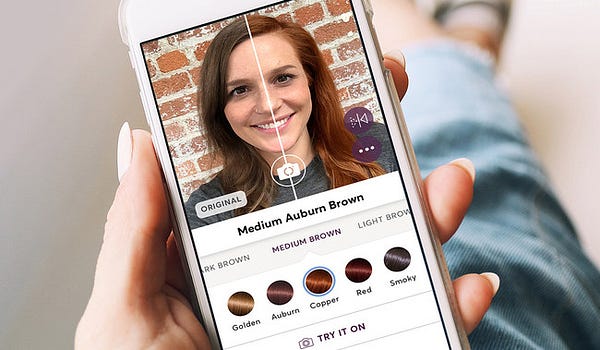

Most recently, Madison Reed unveiled a new “try-on” tool that helps customers to give themselves a virtual makeover. Madison Reed worked with Perfect Corp. — the parent company of beauty app YouCam Makeup — to integrate a palette of more than 45 hair colors into a live, virtual, try-on tool, powered by proprietary augmented reality, artificial intelligence, and color-matching technologies.

“Our goal is to eliminate any fear factor and enable people to choose a new hair color with the confidence of having already witnessed the end result,” says Errett.

In other words, Madison Reed is leveraging technology to reduce CAC.

Madison Reed was one of the first companies to create a dynamic customer intake quiz to match individuals with the right product. This 15-question quiz sits atop a powerful, proprietary algorithm that now has more than 5.5 million hair profiles that make it smarter every day.

The company also innovated early in the chat-based customer service space, with their “ask a colorist” option. These tactics may feel old hat in e-commerce now, but more recent darlings like Care/of and Prose didn’t pull these strategies out of thin air.

Having technology as a core competency gives Madison Reed a tremendous competitive advantage over market incumbents.

The real world.

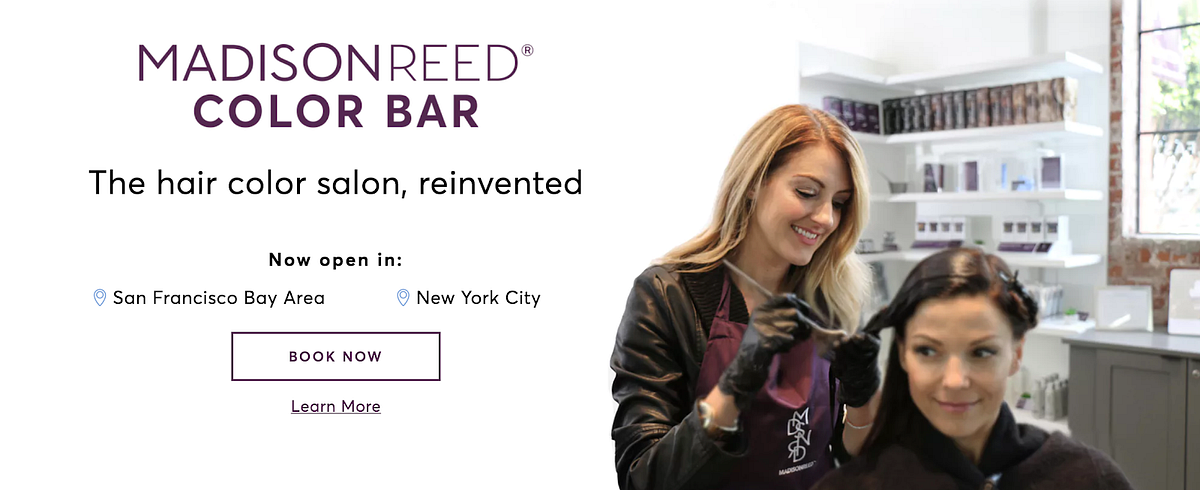

Pop quiz: How much does it cost to get your hair dyed at a salon? In major metropolitan areas, it’s $125 minimum for all-over color and well into the $250-$500 range for highlights, lowlights, and anything-in-between-lights. After raising $25M in 2017, Madison Reed began opening color bars (think Dry Bar for color) where customers can get all-over color for $60.

“We are already disrupting the at-home hair color industry, and we will keep innovating for those women who want to color at home,” Errett says. “But there will always be women who want to have someone else do it.”

“ It’s time for us to turn our attention to disrupting the salon channel, to operationally make it faster, more affordable, and more convenient,” she adds. “There is no reason in the world that a salon appointment should be three hours and $300.”

The at- home hair dye market is slightly north of $1B, but the salon market is much bigger. While Madison Reed started by owning at-home hair dye, they are quickly re-segmenting the market and dramatically increasing their total addressable market (TAM), revenue opportunities, and exit potential.

Procyclical defense

Many DNVB brands are procyclical, meaning they have a positive correlation with the overall health of the economy: when the economy is up, they’re up, and when the economy is down, they’re down. Letting one’s grey shine through is a deeply emotional decision, not an economic one. Women who want to color their hair will keep doing it, and will simply seek less expensive modes of color. For example, at home color vs. in salon, or low cost salon vs. expensive salon . In either event, Madison Reed wins.

Bolt invests at the intersection of the digital and physical world.