One of the more interesting changes for hardware startups over the past few years has been the advent of crowdfunding sites like Kickstarter and Indiegogo. The ability for a young hardware company to demonstrate demand for a product that doesn’t yet exist is revolutionary. Here’s the thing though:

Crowdfunding gives you feedback on how many people would pay to solve a problem, not whether your product actually solves it.

A lot of people talk about what crowdfunding is, so I won’t repeat that here. Let’s take a minute to think about what it’s NOT:

- Crowdfunding does NOT replace customer development. Pre-sales do not equal product/market fit

- Cash in from crowdfunding is NOT the same as raising capital

This is not a test

One of the biggest mistakes we see young hardware companies make is assuming crowdfunding is the same as customer development. Founders think: “if a lot of people buy my product on Kickstarter, then I have a great business!” and “I’ll get a bunch of feedback on Kickstarter about product features!” This is the wrong way to think about product development.

The traditional customer development process is designed to educate you by getting to know hundreds of potential customers. You are NOT trying to learn if customers will eventually buy your product. You ARE trying to learn how people deal with the problem you’re trying to solve, where the pain points are, and what kind of characteristics people that care about this problem have in common. Skipping customer development and going straight to crowdfunding creates a lot of inertia to not change the product or business model, even if you later discover you need to.

Presales != funding

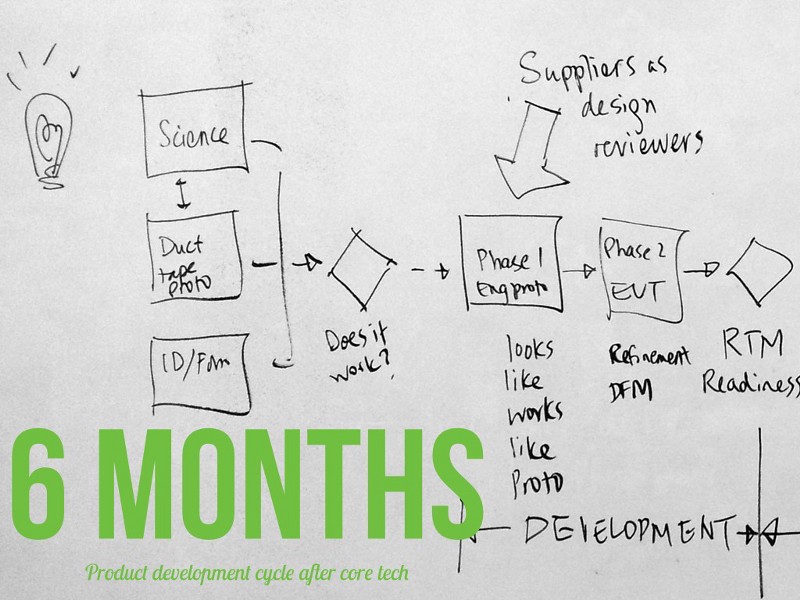

Crowdfunding isn’t equivalent to (seed/VC) funding as the name implies. While lifestyle/consumer goods businesses make sense to launch this way, most consumer electronics products work in highly competitive product categories and need to raise private capital to grow quickly. From my own experience, I’ve learned it takes about 18 months once the “core technology” is validated to develop/manufacture a full product and get it to market (6 months for product development and 12 months for manufacturing/distribution). All too often crowdfunding falls short of the runway necessary to fully deliver and scale distribution. Many successfully crowdfunded hardware products end up in “financing no man’s land” with not enough capital to get to through manufacturing yet not enough traction to raise more capital from investors. This is exceptionally dangerous territory to land in.

Doing it right

An excellent way to avoid this problem is what a few smart startups (like my friends at FormLabs) have done:

- Step 1: Hone in on a problem and solution to focus on by using traditional customer development methods

- Step 2: Raise small family/friends or seed financing, usually $500k-$2M

- Step 3: Do all the hard stuff (additional customer development, hire a team, build a product, hire a CM, design distribution strategy, etc)

- Step 4: Use crowdfunding as a product launch platform when you’re ready to ship within 3 months (like Pebble just did)

- Step 5: Deliver product and make customers happy

- Step 6: Rollout real retail/distribution strategy

Just to demonstrate how hard this is, FormLabs used their $1.8M financing to: build a top-notch team, work out bugs from droves of prototypes, hire a CM, start building tooling, and raise a then-groundbreaking $2.9M on Kickstarter. They were STILL several months late shipping their product.

Delivering hardware is really fucking hard. Crowdfunding drives the stakes even higher.

All in all, crowdfunding can be an exceptionally valuable thing to do for a company’s growth. It is an amazing tool for industrializing the product launch process, financing your first production run, and building a community. If your product has the right DNA, there are few better ways to launch a product. But it’s not a one-stop-shop for everything.

Ben Einstein was one of the founders of Bolt. You can find him on LinkedIn.

Bolt invests at the intersection of the digital and physical world.