This is a 4-part series on what building a scalable hardware business looks like:

Part 1: Team + Prototyping

Everyone bemoans hardware. If I had a dollar every time I heard the phrase “hardware is hard” I would probably be sitting on a beach with a mai tai rather than typing this.

Repeating “hardware is hard” ad infinitum doesn’t help anyone.

It doesn’t help first-time founders navigate the prototyping process or find a Chinese contract manufacturer that will build a great product at scale. It doesn’t help dull the slow, stabbing pain of selling products into big-box retail or figure out what reverse logistics means. It certainly doesn’t help hardware startups raise the right kind of capital. I hope this series of posts is more helpful than repeating “hardware is hard.”

I owe this idea to an anonymous attendee of a talk I gave about a year ago in New York. “I’m tired of hearing how ‘expensive’ and ‘slow’ hardware is,” he whined, “what does that actually mean?” He was totally right. So I put together a 110 slide deck of objective numbers aimed at painting a rough, numerical picture of what starting a scalable hardware business looks like. Over the next few weeks, I’ll cover 8 sections in rough chronological order: team, prototyping, financing, manufacturing, logistics, marketing, retail, and exits. This is the first of 4 blog posts to flush out these 110 ‘numbers’.

Disclaimer

Please do NOT hold me accountable for the specific numbers here. These are averages, extrapolations, and circumspect data from my experience of designing, financing, manufacturing, and selling hardware products over the past several years. These numbers are highly variable and depend hugely on a large array of parameters; think of this as more order-of-magnitude approximations rather than hard rules. That said, feel free to comment where you can and help bring some objective transparency to the process of building a hardware startup.

Okay, here we go:

This is a broken record, but it’s true and it bears repeating: the team you assemble is the most important thing you’ll ever do as a founder. This is especially true with connected hardware products.

Starting a company with a single founder is difficult. Starting a hardware company with a single founder is insane. Jobs was good but Woz was exceptional. Apple would have undoubtedly failed if Jobs was flying solo. We find 2 distinct personalities are optimal: a ‘hacker’ and a ‘dealmaker/hustler’. Roughly speaking this is a tech person and someone who’s willing to focus on everything else.

Getting started with 2+ is great but shipping a solid product (even at small scale) is next to impossible with only 2 people. We’ve found ~8 to be the magic number of employees for getting a basic consumer electronic product into the hands of customers. This usually breaks down to ~4 on the hardware team, ~2 on the software team, and ~2 on operations/marketing/business development. Some companies run leaner and outsource large parts of product development but this is usually sub-optimal for startups (more on that later).

With founders, dividing equity “equally” is usually anything but equal. This isn’t always wrong, but it’s often a sign that co-founders haven’t had hard conversations yet. Usually, one founder has something more useful to add and the equity should reflect that. If you decide that 50:50 (or 33:33:33 or whatever) makes sense for your founding team, be able to defend why.

When it comes to hiring your first employee, be prepared to shell out 2–5% of your company to get that employee on board. Then a fair but generous division of equity might be: 10% to the next 10 employees, 5% for the next 20 employees, and another 5% to the next 50 employees. This sets your first 80 employees up to be highly focused on long-term upside.

But sometimes that exceptional person comes along that you simply can’t live without hiring (Jony Ive in the case of Apple). These “must have hires” can be the difference between an okay team and a superstar one. It’s okay to give them a large piece of equity: 3–10%.

Keep in mind that a hired CEO will often retain somewhere between 7–10% of the company after a Series A financing. If your company needs this, be prepared for a big chunk of equity to go their way. Obviously, few founders plan for this and many VCs think it needs to be done at some point. Talk about this with your investors before signing paperwork!

Young founders sometimes fail to institute a vesting policy for their employees. This is a huge mistake. Vesting is good for everyone, including the founders, the advisors, and the employees. A 4 year vesting period with a 1 year cliff is standard for employees and founders.

This one kills me. If you’ve already formed your corporate entity and haven’t filed an 83(b) election, fire your lawyer. NOW. This simple document means you pay taxes on all of your equity immediately upon it being granted, rather than as it vests. This is particularly important as the value of your equity will dramatically increase over time (hopefully) and if you fail to file an 83(b) election, you will be required to pay taxes each year as the value increases.

Another classic rookie mistake: failure to setup a stock option pool for new employees prior to financing. This one won’t kill you like the 83(b) but it’s the smart thing to do. Two reasons for this:

- Having an established option pool (minimum of 10%) set aside helps you manage hiring new employees without complex equity recalculations.

- More importantly, it signals to investors that you know what you’re doing and are preparing for growth.

This is extra important for a hardware company as you’ll likely need more employees earlier in the lifecycle of the company.

The startup community is littered with horror stories of founders being fired by the “big bad powerful VC board.” This is almost always untrue or incomplete. A board of 3 or 5 people with at least 1 outside (non investor, non employee) member can be one of the most efficient ways to leverage your time and network as a CEO. Even if it’s just an informal monthly meeting of mentors, these groups will help keep the management team on-track, organized, and accountable. But be extremely careful who you put on your board!

Building products that delight users is the only way to build a great hardware company. Period. Unlike software, building prototypes for hardware products often is the long pole in the tent during product development. Knowing what and how to prototype can help you build a better product, in less time and using less capital.

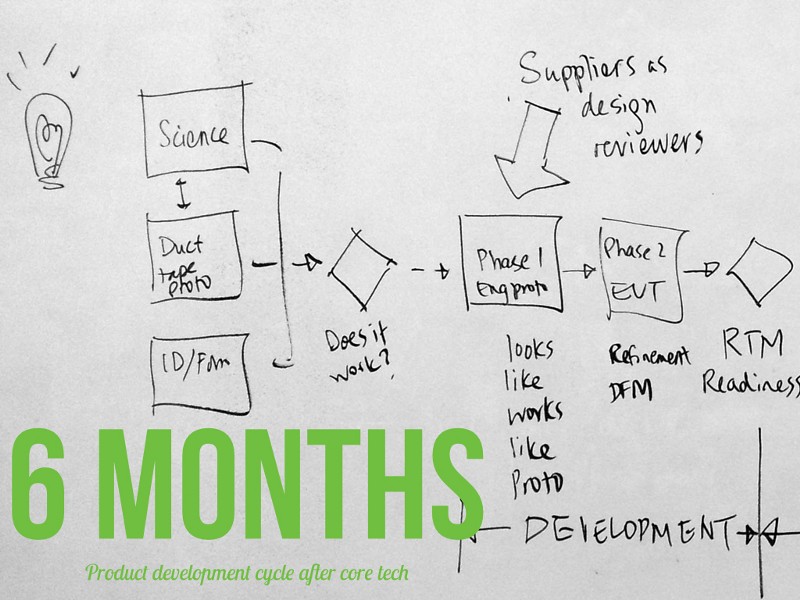

While the process can be hugely variable depending on the product, market and team makeup, one thing doesn’t change: expect to spend 6 months in core product development from ideation through a final, functional prototype. In the 25 or so products I’ve worked on, never once did a product take less than 6 months to get ready for production.

Build. Build. Build. And build more. Small teams can move fast and learn faster by constantly building. I usually suggest building at least 1 physical model per week. It doesn’t need to be a fully functional prototype, but testing a new small feature or a looks-like foam model is useful to keep the ball constantly moving.

But prototypes sitting on a shop bench don’t help much: showing them to other people is critical to get feedback on form, function, size, texture, weight, and ease-of-use. I’ve found building solid relationships with at least 30 potential customers helps build statistically relevant feedback. Keep in mind these are relationships that take time and generosity to be helpful.

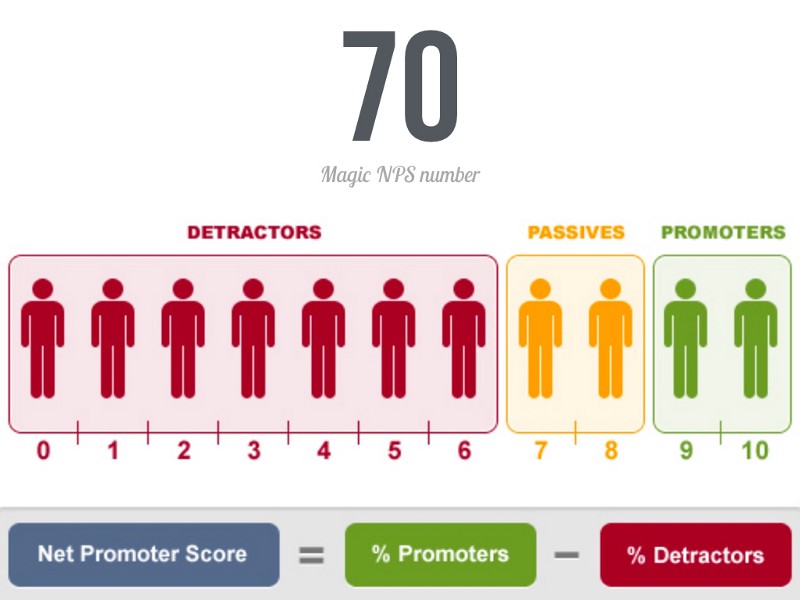

Net Promoter Score (commonly known as NPS) is your compass for measuring reactions from consumers with prototypes as you build them. The simple question “how likely are you to recommend this product to a friend?” drives much of the underlying psychology of consumer behavior and is a good indictor of finding product/market fit. A product with an NPS of 70 is exceptionally good.

Many young companies don’t have high-caliber design talent on their team, especially for hardware components. Founders (rationally) often begin exploring outsourcing the product design and prototyping of their product. The most famous firms (IDEO, Frog, Fuse Project, etc) can generate fantastic designs of products, but they’re extremely expensive to hire. These top-tier design consultancies can charge upwards of $500K for a full development cycle. There are plethora of reasons that this makes no sense for startups, even beyond the high cost.

There are many secondary “regional” firms that do very good work but are typically geared to a different client base than the top-tier firms (like my friends over at Altitude in Somerville, MA). They can be a good option if a startup needs focused “overflow” support on a specific project, but are usually too expensive for most startups weighing in at $50k-$100K for most simple CE products.

If you’re morally opposed to hiring a full-time hardware design person, hiring a contractor is usually the next best path. Finding high-potential independent consultants can be challenging, but they’re out there. Looking at recent graduates from schools like RISD can be extremely cost effective if A) you know what to look for and B) have suitable engineering talent to ensure the product that is designed can actually be built. Spending as little at $10K for this type of setup is totally possible.

The number of people that pitch us at Bolt with an “amazing survey” with “thousands of people” that “can’t wait to buy our product” is astounding. When it comes to market validation, surveys are worth as much as the paper they’re printed on (0% useful). The only way to actually know if someone will buy your product is…surprise: sell it to them! There are all kinds of “hacks” to demonstrate potential market interest, use some of them.

While we can debate whether or not infinity is a number, McMaster-Carr is the undisputed king of prototyping resources. Rather than building droves of custom parts for your product, pay a little extra and buy them off the shelf. Don’t worry, they show up in 24 hours for next to nothing. Oh: and the user experience of shopping with them is among the best in the world.

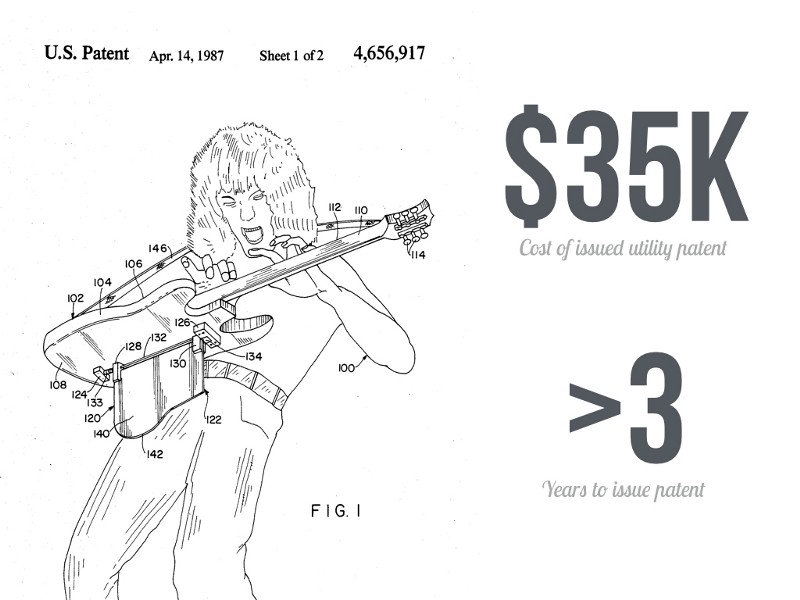

For some reason, hardware founders seem to have an odd predisposition for filing utility patents as soon as they have an idea. In most cases, this is a massive waste of time, energy, and money. Patents can be critical during certain stages of a product development or for certain types of technology, but almost always founders are better off spending the average $35K/patent and >3 years till issue on other stuff (like staff, manufacturing, or I don’t know, bean bag chairs).

That covers the objective facets of Team and Prototyping. For Part 2 on Financing and Manufacturing click here.

Ben Einstein was one of the founders of Bolt. You can find him on LinkedIn.

Bolt invests at the intersection of the digital and physical world.