There’s been a cambrian explosion of new hardware products in the last five years. Some of these are just cheaper or better versions of existing products. Some are entirely new product categories. With all the noise out there, how should founders think about competition? Should you use conventional distribution channels or go direct? How much will you need to spend on marketing and customer acquisition? To answer these questions, it’s helpful to understand what kind of market you’re in. In the Steve Blank school of thought, there are 3 types of markets. Here’s how they apply to hardware startups.

New Hardware Markets

Hardware startup land is littered with the failure of companies working in new product categories. These companies are often the most expensive and take the longest to start because who your core users are, how you reach them, and what features they really care about are largely unknown. Magic Leap is a great example here. Augmented reality is the future, but it’s hard to predict how long it’ll take to commercialize or what the killer use cases will be.

When working in new hardware markets:

- Companies often have to pioneer new ways of distribution. Best Buy doesn’t know where to place your product in the store and consumers aren’t used to searching for you. Which category on Amazon does a social robot fit into? How do you convince customers to buy something they don’t know exists?

- Because it’s initially unclear who your core users are, it takes longer to find product/market fit. So, having enough runway is critical. Just look at companies like Lytro or Leap Motion who have had to pivot multiple times.

- Companies who are successful at educating the market usually have the advantage of brand name recognition. Think Fitbit and fitness trackers

Examples: Fitbit, DJI, 3DR, Oculus, Jibo, Thalmic Labs, Leap motion, Lytro, Scanadu, Leeo, Navdy, Automatic, Coin, Thync, Om Signal, Athos, 6sensor labs

Re-segmented Markets

Startups trying to re-segment existing markets are the most common type of pitch we see. There are two main flavors of this: re-segmentation via low cost and re-segmentation via niche.

Re-segmentation via low cost

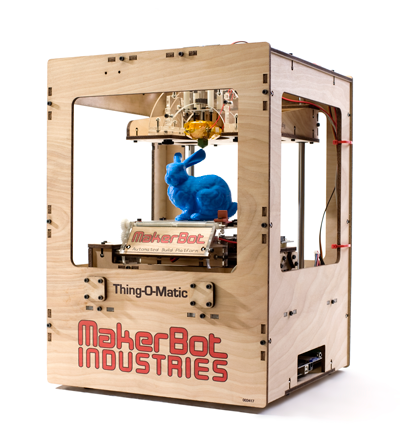

In some markets, many more customers would be interested in a product if it were cheaper. These customers are willing to make do with fewer features as long as the product is good enough. The prototypical example here is MakerBot. High end FDM 3D printers existed for many years before Bre Pettis and the team brought the cupcake printer to market.

When re-segmenting via low cost:

- The low-end of the market is sometimes abandoned by incumbents for the right reasons. Is there a profitable business model down here?

- If you’re successful at this, commoditization will be a big issue. If you could engineer this, can’t others?

Examples: Simplisafe, Glowforge, Formlabs

Re-segmentation via niche

In other hardware markets, startups work in product categories that users already understand, but focus on a niche that REALLY appeals to a small subset of users. This early adopter demographic is hopefully excited enough about the niche product to abandon existing brand loyalties. Over time, these niches can sometimes grow to dwarf the old market and create a new market entirely. The best hardware example here is GoPro.

When re-segmenting via niche:

- You don’t have to totally re-educate the market as you’re segmenting an existing product category that customers already understand. I know what a camera is, so I also have an idea what an action camera should be.

- There’s a risk that the niche is too small and doesn’t support the economies of scale needed to be a successful hardware company. Most consumer hardware companies don’t make real money until they start shipping hundreds of thousands of units. Is your niche large enough to support this?

- There is a risk that consumers don’t care enough about the features of a niche product to change existing behaviors. Lots of IOT products probably fall into this trap. Does the world really need a connected egg tray?

- I would argue that lots of hardware startups think they’re re-segmenting an existing product category by niche when they’re really entering a new product category. Just because I know what a baby monitor is doesn’t mean I understand what a smart baby monitor does. Do consumers intuitively understand your product niche or is there education involved?

Examples: Dropcam, Sonos, 4Moms, August, Pebble, Peloton, Canary

Existing markets

Existing markets are generally the hardest to enter because they’re dominated by incumbents. Building a premium brand is usually the only way to win as a small company. Beats is the prototypical hardware example.

When working in existing markets:

- Companies succeed by building premium brands, having sustainably better technology, or being close to their costs of production. The headphone market is a great example here: Think Beats (premium brand) vs. Bose (better tech) vs AmazonBasics (closest to costs of production)

- Because existing markets are often hyper competitive and dominated by incumbents, this kind of company usually isn’t a great fit for venture investment in the early days. Many of these companies tend to bootstrap until they’re large enough for debt or private equity investors.

Examples: Anker, Mophie, UE, etc

Take Aways

Knowing what kind of market you’re in helps founders prioritize and focus.

- Working in a new market? Having enough runway is critical.

- Re-segmenting via low-cost? Know how you’ll deal with commoditization.

- Re-segmenting via niche? Make sure there are enough consumers who care.

- Working in an existing market? Focus on bootstrapping to profitability. It’s likely hard to raise early venture dollars.

What kind of market are you in?

Bolt invests at the intersection of the digital and physical world.